January 18, 2024 – Read the below newsletter for the latest Mortgage Banking and Consumer Finance industry news written by Ballard Spahr attorneys. In this issue we review the highlights of 2023, as well as discuss various issues faced by lenders and servicers when attempting to foreclose on “zombie” mortgages.

In This Issue:

- SCOTUS Slated to Make Lasting Impact on Consumer Financial Services Industry in 2024

- This Week’s Podcast Episode: Foreclosing on “Zombie” Mortgages: What Lenders and Servicers Should Know

- Money Laundering Watch: 2023 Year in Review

- Final CTA Access Rule Answers Some Questions, and Leaves Open Others

- CFPB Issues Two New FCRA Advisory Opinions on Background Screening Reports and Disclosure of Credit Files to Consumers

- CFPB Files Amicus Briefs in FDCPA Case and Also Files Amicus Brief in FCRA Case Jointly With FTC

- U.S. Senate Fails to Override Veto of Legislation Rejecting CFPB Section 1071 Small Business Lending Rule

- Trade Group for Providers of Commercial Sales-Based Financing Files Lawsuit Challenging CFPB Final Small Business Lending Rule

- U.S. Department of Labor Issues Final Rule on Independent Contractor Status Under the FLSA

- CFPB Announces Availability of HMDA Filing Platform for 2023 Data

- FHFA Cites Underutilization of Appraisal Time Adjustments

- OCC to Host Public Hearing on Appraisal Bias

- CFPB Adjusts Various Penalty Amounts Based on Inflation

- Wisconsin Senate Proposes New Bill to Revise Money Transmission, Consumer Lenders, Collection Agency, and Other Financial Services Licenses

- Looking Ahead

SCOTUS Slated to Make Lasting Impact on Consumer Financial Services Industry in 2024

This New Year is setting up to be a momentous one for the consumer financial services industry in the United States Supreme Court. In 2024, the Supreme Court is expected to decide four impactful cases that may hold that the CFPB’s funding is unconstitutional, eliminate giving deference to CFPB, FTC and federal banking agency regulations, severely narrow National Bank Act (NBA) preemption of state laws, and limit the time during which a plaintiff may sue an agency to facially challenge an agency rule. We cannot recall a prior year in which the Supreme Court considered so many cases which impacted the consumer financial services industry.

Constitutionality of CFPB Funding: There is hardly a soul who isn’t aware of CFSA v. CFPB, the existential challenge to the CFPB arising from the manner in which the CFPB is funded exclusively by the Federal Reserve System and not through Congressional appropriations. The case has been fully briefed and argued and a decision will be forthcoming between now and the end of June. See some of our prior blog posts here and here.

Our Consumer Finance Monitor Podcast has devoted three episodes to this case. In May 2023, we released a podcast episode, “CFSA v. CFPB moves to U.S. Supreme Court: a closer look at the constitutional challenge to the Consumer Financial Protection Bureau’s funding,” in which our special guest was GianCarlo Canaparo, Senior Legal Fellow in the Heritage Foundation’s Edwin Meese III Center for Legal and Judicial Studies. In January 2023, we released a two-part episode, “How the U.S. Supreme Court will decide the threat to the CFPB’s funding and structure,” in which our special guest was Adam J. White, a renowned expert on separation of powers and the Appropriations Clause. To listen to the episode, click here for Part I and click here for Part II. After the oral argument, we also presented a webinar roundtable in which we featured six lawyers who filed amicus briefs supporting a variety of positions. To listen to the podcast episode (which was repurposed from the webinar): “The U.S. Supreme Court’s Decision in Community Financial Services Association of America Ltd. v. Consumer Financial Protection Bureau: Who Will Win and What Does It Mean?,” click here for Part I and click here for Part II.

Chevron Judicial Deference: The next two cases (Loper Bright Enterprises, et al. v. Raimondo and Relentless, Inc. v U.S. Department of Commerce) will likely determine whether the Supreme Court will overturn its 1984 opinion in Chevron, U.S.A., Inc. v. Nat. Res. Def. Council, Inc., which created a framework for courts to use when deciding whether to uphold the validity of federal agency regulations (Chevron Deference). Under Chevron Deference, a court will typically use a two-step analysis to determine if the court must defer to an agency’s interpretation. In step one, the court looks at whether the statute directly addresses the precise question before the court. If the statute is silent or ambiguous, the court will proceed to step two and determine whether the agency’s interpretation is reasonable. If it determines the interpretation is reasonable, the court must defer to the agency’s interpretation. If Chevron Deference is rejected by the Supreme Court, regulated entities may no longer be able to rely on regulations to ensure compliance with federal law. Even worse, regulated entities may no longer be able to rely on regulations that have been previously validated by courts exclusively based on Chevron Deference. Will the Supreme Court 1996 opinion in Smiley v. Citibank, N.A. still be binding precedent? In that opinion, the Supreme Court relied exclusively on an OCC regulation defining “interest” under Section 85 of the NBA to include late fees on credit cards. That decision held that a national bank could charge late fees allowed by the bank’s home state to cardholders throughout the country and ignore limitations on late fees in the laws of the states where the cardholders reside. These two Chevron Deference cases will be argued on January 17, 2023. As we previously stated, we expect the Supreme Court to overrule the Chevron decision.

National Bank Act Preemption: The next extremely important case is one which will determine whether the OCC’s regulations promulgated in 2011 after the enactment of Dodd-Frank too broadly purport to preempt state consumer protection laws. In Cantero v Bank of America, the Supreme Court will decide whether the NBA preempts New York state law requiring the payment of interest on mortgage escrow accounts. The Department of Justice just filed an amicus brief arguing that the OCC’s 2011 regulations contradict the amendments to the NBA made by Dodd-Frank. If the Supreme Court agrees with DOJ’s opinion, many national banks, particularly those engaged in interstate lending or deposit-taking, will need to take a fresh look at whether they need to comply with a whole array of state consumer protection laws. In December, we released a podcast episode, “What recent developments in federal preemption for national and state banks mean for bank and nonbank consumer financial services providers,” discussing the implications of the Supreme Court’s review of NBA preemption (other than Section 85 of the NBA which deals with interest which national banks may charge). The case is in the process of being briefed.

Timing for Facial Challenge to Regulations: Lastly, in Corner Post, Inc. v Board of Governors of the Federal Reserve System, the Supreme Court agreed to decide when a right of action first accrues for an Administrative Procedure Act (APA) Section 702 challenge to a final rule issued by a federal agency—when the final rule is issued or when the rule first causes injury. This case involves a merchant who sued the Federal Reserve Board seeking to invalidate its Regulation II dealing with capping debit card interchange fees. The district court and Eighth Circuit ruled that the six-year statute of limitations for bringing facial APA claims (28 U.S.C. § 2401(a)) begins to run when a final rule is issued, which meant that the limitations period had run before the merchant had opened his doors for business. In its brief, the Petitioner argues that if the statute of limitations for bringing a facial challenge under the APA can expire before a plaintiff is injured by final agency action, a plaintiff seeking to challenge a regulation beyond the six-year period would be forced to intentionally violate a regulation to induce an enforcement proceeding to manufacture an “as applied” challenge. The Federal Reserve argues in its brief that the tolling provision in 28 U.S.C. § 2401(a) would be unnecessary if the statute of limitations did not begin to run until a final rule first caused injury. Twelve amicus briefs have been filed in the case, including a brief supporting the Petitioner filed by the West Virginia Attorney General and 17 other states. Oral argument has not yet been scheduled.

____________________________________________

In this New Year, our blog, Consumer Finance Monitor Blog, and weekly episodes of our Consumer Finance Monitor Podcast will continue to be your best sources for following these cases and analyzing the Supreme Court opinions which will be issued before July 1, 2024.

Alan S. Kaplinsky & Kristen E. Larson

We discuss various issues faced by lenders and servicers when attempting to foreclose on “zombie” mortgages, meaning second mortgages on which the borrower has not made a payment for a considerable period of time and the lender or servicer has not previously taken action to foreclose. First, we look at the CFPB’s May 2023 advisory guidance on the enforcement of time-barred mortgage loans. We then discuss defenses to foreclosure raised by borrowers, specifically that the loan was charged-off, discharged in a bankruptcy, or time-barred, and look at decisions in the states of Washington, Colorado, and Utah in which courts have addressed these defenses. We conclude with a discussion of steps that lenders and servicers should consider taking before attempting to foreclose on a “zombie” mortgage.

Melanie Vartabedian and Matthew Morr, partners in Ballard Spahr’s Consumer Financial Services Group, discuss the issues.

To listen to the episode, click here.

Money Laundering Watch: 2023 Year in Review

Farewell to 2023, and welcome 2024. As we do every year, let’s look back.

We highlight 10 of our most-read blog posts from 2023, which address many of the key issues we’ve examined during the past year: criminal money laundering enforcement; compliance risks with third-party fintech relationships; the scope of authority of bank regulators; sanctions evasion — particularly sanctions involving Russia; cryptocurrency and digital assets; AML enforcement by the SEC; and BSA/AML compliance and its tension with de-risking.

- Binance Settles Criminal and Civil AML and Sanctions Enforcement Actions for Billions – While its Founder, Owner and Former CEO Zhao Pleads Guilty to Single AML Crime

- FinCEN Analysis Reveals Patterns and Trends in Suspected Evasion of Russia-Related Export Controls

- SEC Issues Alert Outlining Deficiencies in Broker-Dealers’ AML Compliance

- Hamas, Terrorist Financing, and Cryptocurrency

- SDNY Sentences Danske Bank in Massive AML Scandal

- All Roads Lead to Roman: Alleged Tornado Cash Co-Founders Roman Storm Arrested and Roman Semenov Sanctioned, Days After Treasury Defeats Lawsuit Challenging OFAC

- Will Ciminelli’s Impact on Wire Fraud Cases Ripple Out to Bank Fraud?

- Department of Treasury Issues Strategy on De-Risking

- SDNY Court Finds Broad Fed Powers Over Master Accounts in Puerto Rican Bank Case Involving AML Concerns

- OCC Risk Perspective Report Focuses on Third-Party Relationships with Fintechs

We move on to 2024. It will be another critical year, as the Corporate Transparency Act (“CTA”) is now in effect — with regulations pertaining to the alignment of the CTA and the Customer Due Diligence Rule still to come. FinCEN also is expected to issue proposed regulations for the real estate industry, AML whistleblowing, and, potentially, investment advisors. Criminal and regulatory enforcement relating to digital assets and fintech and third-party relationships will continue. We look forward to keeping you informed throughout 2024 on these and other developments.

We also want to thank our many readers around the world who continue to make this blog such a success. The feedback we receive from financial industry professionals, compliance officers, in-house and external lawyers, BSA/AML consultants, government personnel, journalists, and others interested in this field is invaluable, and we hope you will continue to share your perspectives with us. We pride ourselves on providing in-depth discussions of the important developments in this ever-evolving area.

If you would like to remain updated on these issues, please click here to subscribe to Money Laundering Watch. Please click here to find out about Ballard Spahr’s Anti-Money Laundering Team.

Peter D. Hardy, Celia Cohen, Terence M. Grugan, Beth Moskow-Schnoll, Michael Robotti, Ronald K. Vaske, Siana Danch, Brian N. Kearney, Kelly A. Lenahan-Pfahlert, Alexa L. Levy, Shauna Pierson & Kaley Schafer

Final CTA Access Rule Answers Some Questions, and Leaves Open Others

The beneficial ownership information (BOI) registry under the Corporate Transparency Act (CTA) is now up and running at the Financial Crimes Enforcement Network (FinCEN). This post will follow up on a previous blog regarding the recently-published CTA BOI access regulations (the Access Rule). As we will discuss, the Access Rule leaves open many important questions for financial institutions (FIs) covered by the CTA, as they await further proposed regulations from FinCEN regarding alignment of the CTA with the Customer Due Diligence (CDD) Rule.

The full federal register publication for the Access Rule is here. It is 82 pages long. We therefore have created this separate 13-page document, which is slightly more user-friendly, setting forth only the actual regulations (now published at 31 C.F.R. § 1010.955).

The Basics

The Access Rule allows disclosure of BOI by FinCEN for five groups of audiences, for specific purposes:

- Disclosure to federal agencies for use in furtherance of national security, intelligence, or law enforcement activity;

- Disclosure to State, local, and Tribal law enforcement agencies for use in criminal or civil investigations;

- Disclosure for use in furtherance of foreign national security, intelligence, or law enforcement activity;

- Disclosure to FIs subject to the CDD Rule and their federal regulators to facilitate compliance with CDD Rule requirements; and

- Disclosure to officers or employees of the Department of the Treasury, including for the purposes of tax administration.

As we also previously blogged, access to BOI will be rolled out in phases. FinCEN explains this process as follows in the federal register:

The first stage will be a pilot program for a handful of key Federal agency users starting in 2024, as required MOUs and policies and procedures are completed. The second stage will extend access to Treasury Department offices and certain Federal agencies engaged in law enforcement and national security activities that already have Bank Secrecy Act [Memorandums of Understanding] (e.g., FBI, IRS-CI, HSI, DEA, Federal banking agencies (FBAs)). Subsequent stages will extend access to additional Federal agencies engaged in law enforcement, national security, and intelligence activities, as well as key State, local, and Tribal law enforcement partners; to additional State, local, and Tribal law enforcement partners[.]

Domestic Agencies

Federal, State, local or tribal agencies which receive BOI must enter into an agreement with FinCEN specifying the standards, procedures and systems to be maintained by the agency to protect the security and confidentiality of the information. Their systems must be audited annually, and the head of each agency must certify to FinCEN semi-annually that the agency’s standards and procedures are compliant. The agency also must provide FinCEN with an annual report describing its standards and procedures. Although the Access Rule lays out detailed requirements for a BOI request by an agency, FinCEN still needs to promulgate the proposed forms. The Access Rule states that “[t]he requesting agency shall limit, to the greatest extent practicable, the scope of such information it seeks, consistent with the agency’s purposes for seeking such information.”

State, local and Tribal authorities may obtain BOI if they certify that they have received “court authorization.” FinCEN has stated that “as a policy matter, it will not conduct individual reviews of each request for BOI by State, local, or Tribal law enforcement agencies when they are submitted. Rather, consistent with requirements of the CTA, FinCEN will conduct robust audit and oversight of State, local, and Tribal law enforcement agency searches for BOI to ensure that BOI is requested for authorized purposes by authorized recipients.”

Foreign Recipients of Information

Foreign requesters will not have direct access to the BOI database. Instead, they will submit their requests for BOI to Federal intermediary agencies, which will need to be identified. If the foreign request is approved, then the Federal agency intermediary will retrieve the BOI from the system and transmit it to the foreign requester.

The Access Rule states that upon receipt of a request for BOI “from a Federal agency on behalf of a law enforcement agency, prosecutor, or judge of another country, or on behalf of a foreign central authority or foreign competent authority (or like designation) under an applicable international treaty, agreement, or convention,” FinCEN may disclose BOI if the request “is for assistance in a law enforcement investigation or prosecution, or for a national security or intelligence activity, that is authorized under the laws of the foreign country;” and (ii) the request is either “[m]ade under an international treaty, agreement, or convention;” or, if no such treaty, agreement, or convention exists, the request is an “official request by a law enforcement, judicial, or prosecutorial authority of a foreign country determined by FinCEN, with the concurrence of the Secretary of State and in consultation with the Attorney General or other agencies as necessary and appropriate, to be a trusted foreign country.” The key word in the last sentence is “trusted.”

Financial Institutions

FIs obtaining BOI from FinCEN must implement “administrative, technical, and physical safeguards reasonably designed to protect the security, confidentiality, and integrity of such information.” FIs generally may satisfy these requirements by complying with the Gramm-Leach-Bliley Act (“GBLA”), or, if the FI is not directly subject to the GBLA, procedures which satisfy GBLA requirements. Further, an FI must obtain and document the prior consent of the reporting company to the FI’s request for its BOI. In regards to customer consent, FinCEN has explained that “reporting company consent must be documented but need not specifically be in writing . . . Financial institutions may satisfy this requirement through any lawful method of obtaining meaningful consent from a customer. As a consequence of offering this flexibility, however, FinCEN cannot offer a safe harbor for any particular method used to obtain consent.”

Again, FinCEN still must promulgate the proposed form for FIs to request BOI.

The Access Rule removes a requirement in the initially proposed regulations that BOI access by FIs is limited to personnel within the U.S. However, FIs must notify FinCEN within three days of receiving a request from a foreign government, law enforcement entity or party for access to BOI held by the FI. Further, FIs cannot store BOI in, or make it available to persons located in, certain geographical jurisdictions, such as China, Russia or a jurisdiction that is blocked by U.S. sanctions.

More fundamentally, FIs may obtain BOI in order to “facilitate compliance with customer due diligence requirements.” As FinCEN explains in the federal register, “[t]he revised regulation now specifies that the clause ‘customer due diligence requirements under applicable law’ includes ‘any legal requirement or prohibition designed to counter money laundering or the financing of terrorism, or to safeguard the national security of the United States, to comply with which it is reasonably necessary for a financial institution to obtain or verify beneficial ownership information of a legal entity customer.’” The Access Rule therefore broadens the purposes for which FIs may use BOI, as compared to the initially proposed regulations regarding access. Although FinCEN still needs to issue proposed regulations aligning the CTA with the CDD Rule, the Access Rule makes clear that, unlike the previously proposed BOI access rule, FIs will not be confined to requesting and using CTA BOI only for “pure” CDD Rule compliance. Instead, FIs will be able to access CTA BOI more broadly, such as for the purposes of maintaining their BSA/AML compliance program; compliance with sanctions screening; potential filing of SARs; and conducting enhanced due diligence. This is an important revision, which attempts to address prior criticisms from FIs and other stakeholders that broader access to BOI is necessary to both effectuate the goals of the CTA and for FIs to comply more effectively with the BSA in general.

In the federal register, FinCEN states that the Access Rule “does not require [FIs] to access the BOI database, nor does it speak to what [FIs’] obligations may be once the 2016 CDD Rule is revised.” Accordingly, the forthcoming proposed CDD Rule alignment regulations will need to address several important remaining questions and potential challenges facing FIs, including the following:

- First, they should reiterate that FIs are not required to access the BOI database – particularly because FinCEN’s BOI reporting form will allow reporting companies to not provide key information. Even if the CDD Rule revision so states, however, it may become the case as a practical matter that regulators nonetheless expect FIs to access the CTA database as part of their overall BSA/AML compliance.

- Second, they should provide a clear and practical mechanism for FIs to address situations in which BOI collected under the CDD Rule does not match BOI obtained through the CTA – particularly because FinCEN has indicated that it will not verify the accuracy of BOI collected under the CTA.

- Third, and assuming that the proposed regulations change the current exceptions to CDD Rule reporting (because exceptions to reporting under the CTA and the CDD Rule are currently different), they should explain clearly how FIs can effectively adjust their current CDD Rule reporting systems, which have been in place for years, and provide sufficient time to do so.

- Finally, they should state explicitly that FIs may rely on BOI obtained from the CTA database, just like FIs may rely upon BOI obtained from customers under the current CDD Rule.

More to Come

FinCEN recognizes that significant future guidance is necessary. Overall, the preamble in the federal register mentions several instances where FinCEN recognized a specific area needing further guidance and the public having more questions. FinCEN already has a link to submit BOI- and CTA-related questions on its website. Examples of likely future efforts and guidance include:

- “FinCEN is currently working to implement and staff a dedicated beneficial ownership contact center to field both substantive and IT-related inquiries. FinCEN has also hired additional full-time staff who will be assigned to support the beneficial ownership portfolio and has procured additional contractor support for FinCEN’s CTA implementation efforts. Any changes to FinCEN’s plans to implement the CTA will be clearly communicated to the public and stakeholders.”

- FinCEN is not creating a specific re-disclosure provision in 31 C.F.R. § 1010.955(c)(2) addressing joint investigations and law enforcement task forces. “Instead, FinCEN will address joint investigations and task forces in future guidance, with an eye toward issuing guidance that captures the most common or straightforward circumstances, and in more unusual or complex situations evaluating specific re-disclosure requests on a case-by-case basis . . . . This approach permits FinCEN greater flexibility in crafting appropriate rules for varied circumstances.”

- “FinCEN understands that financial institutions might want or need to re-disclose BOI from FinCEN to parties that are not their directors, officers, employees, contractors, agents, or regulators . . . . These are typically complex arrangements with highly variable facts and circumstances that do not lend themselves well to one broad regulation. FinCEN will therefore address these issues in future guidance, with an eye toward evaluating specific re-disclosure requests on a case-by-case basis . . . to approve in writing re-disclosure of BOI in furtherance of an authorized purpose or activity.”

Costs

In response to multiple pointed comments, FinCEN admits that it previously misjudged the cost and time estimate to comply with the CTA. The federal register contains many pages devoted to estimated costs for both FIs and government.

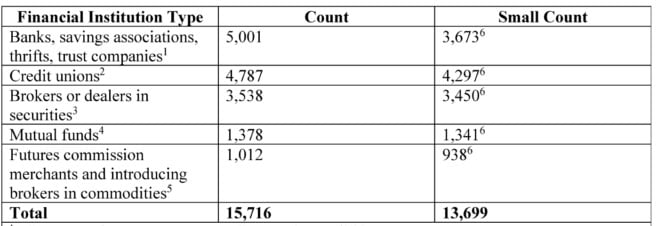

Here is Table 1 from the federal register, setting forth the estimated amount of FIs affected by the CTA. Recall that this table only pertains to FIs covered by the CDD Rule, rather than all FIs subject to the BSA. The column entitled “Small Count” refers to FinCEN’s determination that most FIs are “small” entities, defined as having total assets or annual receipts less than the Small Business Association (“SBA”) small entity size standard for the FI’s particular industry. For example, the SBA currently defines a commercial bank, savings institution or credit union as “small” if it has less than $850 million in total assets.

Ultimately, FinCEN now estimates that the total annual hourly burden for CTA compliance will be over 8.7 million hours during the first year, and over 3.6 million hours during subsequent years. Although these estimates include estimated hours for State, local and Tribal agencies, the vast majority of the hours are attributable to FIs. The actions requiring projected hours by FIs include developing and implementing administrative and physical safeguards; developing and implementing technical safeguards; obtaining and documenting customer consent; submitting certifications for each request that it meets certain requirements; and training.

If you would like to remain updated on these issues, please click here to subscribe to Money Laundering Watch. Please click here to find out about Ballard Spahr’s Anti-Money Laundering Team.

On January 11, 2024, the Consumer Financial Protection Bureau (CFPB) issued two new advisory opinions: Fair Credit Reporting; Background Screening and Fair Credit Reporting; File Disclosure. The advisory opinions are part of the CFPB’s ongoing efforts to clean up what the CFPB describes in its press release as allegedly “sloppy” credit reporting practices and ensure credit report accuracy and transparency to consumers. As a reminder, advisory opinions are interpretive rules that provide guidance on the CFPB’s interpretation of a particular law or regulation.

The Biden Administration kicked off 2023 by issuing the “Blueprint for a Renter Bill of Rights” and directing the CFPB and Federal Trade Commission (FTC) to take actions in furtherance of those principles. In February, the CFPB and FTC issued a request for information on background screening in connection with rental housing. In July, the FTC issued a blog post reminding landlords, property managers, and other housing providers of their obligation under the Fair Credit Reporting Act to provide notice of adverse action when information in a consumer report leads them to deny housing to an applicant or require the applicant to pay a deposit that other applicants would not be required to pay. In November, the CFPB released two reports concerning tenant background checks. “Consumer Snapshot: Tenant Background Checks” discusses consumer complaints received by the CFPB that relate to tenant screening by landlords and “Tenant Background Checks Market” looks at the practices of the tenant screening industry. The CFPB has previously addressed the issues of accurate credit reporting and investigating credit report disputes in its supervisory highlights.

Background Checks

In the first advisory opinion, the CFPB addresses the provision of background check reports. Background checks are used by landlords and employers to make rental and employment determinations, respectively. Background check reports prepared by employment and tenant screening companies often contain information compiled from several sources about a consumer’s credit history, rental history, employment, salary, professional licenses, criminal arrests and convictions, and driving records. The CFPB advisory says prior research has determined that background check reports often contain false or misleading information that may adversely affect an individual’s housing or employment. In 2021, the CFPB issued an advisory opinion that it was unreasonable for consumer reporting agencies (CRAs) to use name-only matching (matching records to a consumer by first and last name without any other identifying information).

The current advisory opinion highlights that CRAs, covered by the Fair Credit Reporting Act (FCRA), must “follow reasonable procedures to assure maximum possible accuracy” under Section 607(b). Specifically, the CRA’s procedures should:

- Prevent the reporting of public record information that has been expunged, sealed, or otherwise legally restricted from public access;

- Ensure disposition information is reported for any arrests, criminal charges, eviction proceedings, or other court filings that are included in background check reports; and

- Prevent the reporting of duplicative information.

The advisory opinion further reminds consumer reporting companies that they may not report outdated negative information, such as a criminal charge that does not result in a conviction, for periods longer than permitted under FCRA section 605(a). While no time limit applies to reporting disposition information on criminal convictions, an arrest with no conviction ends seven years after the arrest date and subsequent events do not restart the reporting period applicable to the arrest. The CFPB further highlighted its settlement with TransUnion related to furnishing tenant screening reports without including available disposition information for the eviction proceedings.

CRA Disclosure of Credit Files

In the second advisory opinion, the CFPB addresses the consumer reporting agencies’ disclosure obligations to deliver complete files to consumers upon request. In the advisory opinion, the CFPB clarifies the consumer reporting agencies’ obligation, pursuant to Section 609(a) of FCRA, upon the consumer’s request, to “clearly and accurately” disclose “all information in the consumer’s file at the time of the request.” Relying on a Third Circuit holding in Kelly v. RealPage, Inc., 47 F.4th 202, 221 (3rd Cir. Aug. 24, 2022), the CFPB further emphasizes that consumers do not need to use specific language (such as “complete file” or “file”) in their request to trigger a consumer reporting agency’s file disclosure requirement under Section 609(a).

Specifically, the consumer reporting agency must provide consumers the following:

- At least one free file disclosure annually and in connection with adverse action notices and fraud alerts;

- Consumer’s complete file with clear and accurate information that is presented in (i) a way an average person could understand and (ii) a format that will assist consumers in identifying inaccuracies, exercising their rights to dispute any incomplete or inaccurate information, and understanding when they are being impacted by adverse information; and

- All sources for the information contained in consumers’ files, including both the originating sources and any intermediary or vendor sources, so consumers can identify the source and correct any misinformation (noting that only providing summarized information would not be compliant).

However, Section 609(a) does not require disclosure of any credit score, risk score or predictor.

This new file disclosure guidance aligns with the CFPB’s other efforts to ensure consumers have access to their data in Personal Financial Data Rights rulemaking and the Section 1034(c) advisory opinion.

As we previously blogged, the CFPB also has launched an FCRA rulemaking. We will continue to monitor any CFPB developments related to FCRA.

Kristen E. Larson & John L. Culhane, Jr.

CFPB Files Amicus Briefs in FDCPA Case and Also Files Amicus Brief in FCRA Case Jointly With FTC

The CFPB recently filed two amicus briefs, one in a First Circuit case involving the Fair Debt Collection Practices Act (FDCPA) and the other, which was filed jointly with the Federal Trade Commission, in a Fourth Circuit case involving the Fair Credit Reporting Act (FCRA).

FDCPA. The FDCPA case is Carrasquillo v. CICA Collection Agency. The plaintiff, after having filed a bankruptcy, received a collection letter from the defendant seeking to collect a debt he owed for telephone and communication services. In the letter, the defendant stated that the debt was “due and payable” and that the creditor was “fully entitled to initiate a legal action” to collect it. In his lawsuit, the plaintiff alleged that the letter violated numerous FDCPA provisions, in particular the FDCPA provision that prohibits a debt collector from “us[ing] any false, deceptive, or misleading representation or means in connection with the collection of any debt.” The plaintiff claimed that the representations in the collection letter were false because, at the time it was sent, he was protected by the Bankruptcy Code automatic stay. Thus, according to the plaintiff, the debt was not due and the creditor could not commence a debt collection lawsuit against him.

The defendant moved to dismiss, arguing that the Bankruptcy Code precludes FDCPA claims based on the defendant’s attempt to collect a debt notwithstanding the bankruptcy. Alternatively, the defendant argued that the FDCPA prohibits only intentional violations and that because the defendant did not know of the bankruptcy and the accompanying automatic stay, it did not intentionally make any false representations about the debt. The district court granted the motion to dismiss. It declined to address whether the Bankruptcy Code precluded the plaintiff’s FDCPA claims because it found that the claims failed on the merits. The district court held that the defendant’s statements in its letter did not violate the FDCPA because the prohibition in question was intended to prohibit only knowing or intentional misstatements and the defendant was unaware of the bankruptcy proceeding despite the plaintiff’s allegation to the contrary. The plaintiff appealed the dismissal to the U.S. Court of Appeals for the First Circuit.

In its amicus brief in support of the plaintiff, the CFPB argues that the FDCPA prohibition does not implicitly make misrepresentations unlawful only if the debt collector makes them knowingly or intentionally and the district court erred in reading such a scienter requirement into the prohibition. According to the CFPB, this is confirmed by the FDCPA’s plain language and other FDCPA provisions that show Congress knew how to add a scienter requirement when it intended such a requirement to apply. The CFPB also contended that the bona fide error provision in the FDCPA’s civil liability section shows that a debt collector will be liable for unintentional violations if it cannot show that the violations resulted from a bona fide error and it maintained procedures reasonably adapted to avoid such errors. The CFPB asserts that there would have been no reason for Congress to include the language regarding “procedures reasonably adapted to avoid any such error” if a showing that a violation was unintentional was sufficient to avoid liability.

The CFPB also argues that if the First Circuit addresses the issue, it should hold that the Bankruptcy Code does not bar the plaintiff’s FDCPA claims. According to the CFPB, nothing in the text of the Bankruptcy Code or the FDCPA suggests that Congress intended the Bankruptcy code to preclude FDCPA claims where the statutes overlap nor is there any other basis to infer such intent from the statutes.

FCRA. The FCRA case is Roberts v. Carter-Young, Inc. The defendant, a debt collector, had been hired by the apartment complex in which the plaintiff formerly resided to collect an invoice she owed for alleged damage to the stove in her unit. The plaintiff refused to pay the debt, claiming that according to her lease and governing state law, this was an ordinary maintenance issue that the complex could have easily fixed rather than replacing the stove. The defendant reported the debt to the three major consumer reporting agencies (CRAs). When the CRAs forwarded the plaintiff’s dispute to the defendant, the defendant investigated the disputed information, allegedly by asking the apartment complex to recertify the validity of its claim. Based on the complex’s confirmation of the debt’s validity, the defendant confirmed its validity to the CRAs which continued to report the debt.

In her lawsuit, the plaintiff alleged that the defendant violated the FCRA requirement for a furnisher, upon receipt of an indirect dispute from a CRA, to “conduct a reasonable reinvestigation to determine whether the disputed information is inaccurate.” The defendant moved to dismiss for failure to state a FCRA claim, arguing that the FCRA reasonable investigation requirement applies only to asserted factual inaccuracies, not disputes involving legal questions like those at issue in the plaintiff’s dispute with the apartment complex. The plaintiff argued that furnishers have an obligation to investigate both legal and factual disputes. She also argued that her dispute raised factual rather than legal issues.

The magistrate judge found that the FCRA does not impose a duty on furnishers to resolve legal questions and recommended granting the motion to dismiss. The magistrate judge also rejected the plaintiff’s contention that her dispute was factual rather than legal because, in the magistrate’s view, the validity of the debt would have required the defendant to interpret the lease and state landlord-tenant law. The district court adopted the magistrate’s recommendation and dismissed the case. The plaintiff appealed the dismissal to the U.S. Court of Appeals for the Fourth Circuit.

In their amicus brief in support of the plaintiff, the CFPB and FTC argue that, in requiring furnishers to reasonably investigate consumers’ disputes, the FCRA does not distinguish between legal and factual disputes. According to the agencies, any burden imposed on furnishers is mitigated by the fact that the investigation need only be “reasonable.” They also argue that because debts generally arise from contracts, and thus any dispute about a debt might require a review of contract terms, an exclusion for legal disputes “could create a loophole that would gut the requirement to investigate disputes.”

The CFPB and FTC also ask the Fourth Circuit to clarify that the district court erred “to the extent the district court held that the reasonableness of an investigation turns on the information within the furnisher’s possession.”

The CFPB and FTC have filed joint amicus briefs (here and here) in Eleventh Circuit cases that involve the issue of a furnisher’s obligation to perform a reasonable investigation when a consumer disputes the accuracy of information furnished to the CRA, even if the dispute could be characterized as a legal, rather than factual, dispute.

In July 2023, the Second Circuit ruled in Sessa v. Trans Union, LLC that because “there is no bright-line rule that only purely factual or transcription errors are actionable under the [Fair Credit Reporting Act (FCRA)],” the FCRA does not contemplate a threshold inquiry by the court as to whether an alleged inaccuracy is “legal” for purposes of determining whether the plaintiff has stated a cognizable claim under the FCRA. Rather, as the Second Circuit also ruled, a claimed inaccuracy is potentially actionable under the FCRA so long as the challenged information is objectively and readily verifiable. The CFPB and FTC also filed a joint amicus brief in Sessa.

John L. Culhane, Jr. & Joel E. Tasca

Barbara S. Mishkin

As previously reported, in late December 2023 President Biden vetoed legislation adopted by the U.S. House of Representatives and U.S. Senate under the Congressional Review Act to override the CFPB’s final Section 1071 small business lending rule (1071 Rule). The vote in the House was 221-202 and the vote in the Senate was 53-44. Recently, the U.S. Senate voted on whether to override the President’s veto, and the override effort failed by a vote of 54-45, falling short of the necessary two-thirds vote required in both the House and Senate to override a Presidential veto. Thus, regardless of any action taken by the House, the veto will stand.

Nevertheless, currently the CFPB is enjoined from implementing and enforcing the 1071 Rule based on two lawsuits challenging the rule in federal district courts, one in Kentucky, and one in Texas.

The initial rulings in the Kentucky and Texas lawsuits focus on claims by the plaintiffs that the 1071 rule is invalid because the CFPB’s funding structure is unconstitutional, based on the ruling of the U.S. Court of Appeals for the Fifth Circuit that held the CFPB’s funding is unconstitutional in Community Financial Services Association of America Ltd. v. CFPB. On October 3, 2023, the U.S. Supreme Court heard oral arguments in the CFSA v. CFPB case, and a ruling is not expected until as late as June 2024.

The preliminary injunction in the Texas case initially was limited to the plaintiffs and their members, while the preliminary injunction in the Kentucky case was not so limited. The preliminary injunction in the Texas case was later extended to apply on a nationwide basis. The court’s order in the Texas case (1) stays all deadlines for compliance with the 1071 Rule for the plaintiffs and their members, parties that intervened in the lawsuit after the initial ruling and their members, and all covered financial institutions until after the Supreme Court’s decision in CFSA v. CFPB, and (2) requires the CFPB, if the Supreme Court rules that its funding is constitutional, to extend the deadlines for compliance with the 1071 Rule to compensate for the period stayed. The court’s order in the Kentucky case does not provide for such an extension of the compliance deadlines.

As previously reported, recently Revenue Based Finance Coalition (RBFC), a trade group whose members include non-banks that provide sales-based financing to businesses, filed a lawsuit against the CFPB in a Florida federal district court challenging the 1071 Rule. The core argument made by RBFC is that because sales-based financing does not constitute “credit” within the meaning of the Equal Credit Opportunity Act and Regulation B, the CFPB did not have the authority to regulate sales-based financing as “credit” under the 1071 Rule.

Revenue Based Finance Coalition (RBFC), a trade group whose members include non-banks that provide sales-based financing to businesses, filed a lawsuit last week against the CFPB in a Florida federal district court challenging the CFPB’s final small business lending rule implementing Section 1071 of Dodd-Frank. The core argument made by RBFC is that because sales-based financing does not constitute “credit” within the meaning of the Equal Credit Opportunity Act (ECOA) and Regulation B, the CFPB did not have the authority to regulate sales-based financing as “credit” under the Rule.

Section 1071 imposes certain data collection and reporting requirements for “any application to a financial institution for credit for women-owned, minority-owned, or small business.” (emphasis added). The Rule defines the “covered credit transactions” that are subject to the Rule’s requirements to mean “an extension of business credit that is not an excluded transaction [as set forth in the Rule.]” The Rule also provides that “credit” for purposes of what is a “covered credit transaction” has the same meaning as the term “credit” in Regulation B (which implements the Equal Credit Opportunity Act (ECOA)). The ECOA defines “credit” to mean “the right granted by a creditor to a debtor to defer payment of debt or to incur debts and defer its payment or to purchase property or services and defer payment therefor.” Regulation B defines “credit” to mean “the right granted by a creditor to an applicant to defer payment of a debt, incur debt and defer its payment, or purchase property or services and defer payment therefor.”

In its background discussion of the Rule, the CFPB stated:

[T]he Bureau is not specifically defining sales-based financing in the rule because the Bureau believes these products are covered by the definition of ‘‘credit’’ in [Regulation B]. However, based on its review of typical merchant cash advance arrangements and its expertise with respect to the nature of credit transactions, the Bureau believes the term ‘‘credit’’ encompasses merchant cash advances and other type of sales-based financing. As a result, the Bureau believes that merchant cash advances and other sales-based financing are covered by the definition of ‘‘credit’’ in [Regulation B]. The Bureau does not believe it is necessary to specifically define merchant cash advances or sales-based financing because the broad definition of ‘‘credit’’ in ECOA and Regulation B—includes credit products covered by the rule unless the Bureau specifically excludes them.

In its complaint, RBFC alleges that sales-based financing does not qualify as “credit” within the meaning of the ECOA or Regulation B and the data and reporting requirements in Section 1071 only apply to applications for “credit.” According to RBFC:

- By its plain terms, ECOA’s definition of “credit” only applies where a right to “defer” payment of a payment obligation exists and sales-based financing “involves a substantially contemporaneous exchange of value—i.e., rights to a percentage of revenue generated by a business’s sale of goods and services in exchange for the sales-based financing provider’s lump sum payment.”

- ECOA’s definition of “credit” repeatedly uses the term “debt” to describe the payment obligation that has been deferred. Even if sales-based financing does involve deferred payment obligations, it does not involve “debt.” Sales-based financing transactions do not create “debt” because they impose no unconditional obligation to repay and no liability where future receipts do not materialize in the ordinary course of business.

- Sales-based financing functions like nonrecourse factoring arrangements, which are not subject to the ECOA. The Regulation B Commentary provides “[f]actoring refers to a purchase of accounts receivable, and thus is not subject to the Act or regulation.”

- Section 1071 only applies in the context of “small business loan data collection” and repeatedly uses “loan” in a manner that informs the meaning of “credit.” Sales-based financing transactions are not “loans” because the provider bears the risk of business failure, and there are no interest rates or finite payment timelines. (RBFC notes that the CFPB acknowledged in its discussion of the Rule that sales-based financing is generally not covered under state lending laws.)

In challenging the Rule, RBFC makes the following claims under the Administrative Procedure Act (APA);

- Because sales-based financing does not qualify as “credit” within the meaning of the ECOA or Regulation B, the CFPB lacked the statutory authority to regulate sales-based financing as “credit” under the Rule. The court should declare the Rule invalid and set it aside to the extent it purports to apply to sales-based financing pursuant to the APA which provides that a court “shall…hold unlawful and set aside agency action [that is] in excess of statutory jurisdiction, authority, or limitations, or short of statutory right.”

- The Rule is arbitrary and capricious because the CFPB (1) made sales-based financing subject to the Rule to level the playing field between sales-based financing providers and their competitors that provide cash flow financing to small businesses in the form of credit, a factor which Congress did not intend the CFPB to consider, (2) failed to adequately consider costs and benefits, and (3) failed to respond to many of the comments submitted by RBFC on the CFPB’s proposed rule. The court should declare the Rule invalid and set it aside to the extent it purports to apply to sales-based financing pursuant to the APA which provides that a court “shall…hold unlawful and set aside agency action [that is] arbitrary, capricious, an abuse of discretion, or otherwise not in accordance with law.”

The complaint also includes a claim that the Rule should be held unlawful and set aside because the CFPB’s funding mechanism violates the Appropriations Clause of the U.S. Constitution. While the U.S. Court of Appeals for the Fifth Circuit held in CFSA v. CFPB that the CFPB funding mechanism violates the Appropriations Clause, and the matter is now under review by the U.S. Supreme Court, the Florida federal district court is in the jurisdiction of the U.S. Court of Appeals for the Eleventh Circuit and, thus, is not bound by the Fifth Circuit’s decision.

The Rule is also being challenged in two other cases filed in federal district courts, one in Kentucky, and one in Texas. The Kentucky and Texas lawsuits include claims that the Rule is invalid because the CFPB’s funding structure is unconstitutional based on the Fifth Circuit’s ruling and because portions of the Rule also violate various APA requirements. The Kentucky lawsuit also includes a First Amendment claim.

Both the Kentucky and Texas courts issued rulings that preliminarily enjoin the CFPB from implementing and enforcing the Rule. The preliminary injunction in the Texas case initially was limited to the plaintiffs and their members, while the preliminary injunction in the Kentucky case was not so limited. The preliminary injunction in the Texas case was later extended to apply on a nationwide basis. The court’s order in the Texas case (1) stays all deadlines for compliance with the Rule for the plaintiffs and their members, parties that intervened in the lawsuit after the initial ruling and their members, and all covered financial institutions until after the Supreme Court’s decision in the CFSA v. CFPB, and (2) requires the CFPB, if the Supreme Court rules that its funding is constitutional, to extend the deadlines for compliance with the Rule to compensate for the period stayed. The court’s order in the Kentucky case does not provide for such an extension of the compliance deadlines.

John L. Culhane, Jr. & Richard J. Andreano, Jr.

U.S. Department of Labor Issues Final Rule on Independent Contractor Status Under the FLSA

On January 9, 2024, the US Department of Labor (DOL) issued a final rule that provides revised guidance on whether a worker is properly classified as an employee or independent contractor under the Fair Labor Standards Act (FLSA). Under the FLSA, employees are entitled to minimum wage and overtime pay, while independent contractors are not. The DOL’s new rule is slated to go into effect on March 11, 2024.

The DOL and courts have traditionally used the “economic realities” test to assess whether workers are economically dependent on the employer for work or are in business for themselves. The final rule, which is consistent with the proposed rule issued on October 11, 2022, requires that each factor in the economic realities test must be considered equally. The six primary factors are:

- the worker’s opportunity for profit or loss;

- the amount of investment by the worker;

- the permanency of the working relationship;

- the nature and degree of the employer’s control over the work;

- whether the work is an integral part of the employer’s business; and

- the worker’s skill and initiative.

Under the previous rule issued by the Trump administration in 2021, two “core factors” in the economic realities test—the worker’s opportunity for profit and loss and the degree of the employer’s control over the work—were given greater weight (and a more expansive interpretation), making the test more employer-friendly. The reframing of the analysis back to equal consideration of all factors may make it more likely that workers will be found to be employees entitled to protections under the FLSA. The DOL’s new rule reflects a continuing focus on this issue under the current administration. For example, in June 2023, the National Labor Relations Board issued a decision reverting to its previous test for determining whether workers are employees covered by the National Labor Relations Act (“NLRA”), or independent contractors who are not, moving from focusing on “entrepreneurial opportunity” to applying its previous multifactor test.

The stakes will be high in any lawsuit brought by alleged employees under the new rule. Workers who claim they were misclassified as independent contractors may pursue claims for up to two years (three years for willful violations of the law) of unpaid overtime and minimum wages. Additionally, successful plaintiffs may obtain liquidated damages and attorneys’ fees. Lawsuits under the FLSA are often brought as collective actions, on behalf of large groups of employees, raising the potential for significant liability for businesses who misclassify workers.

Employers in the gig economy and in traditional businesses who use independent contractors should review their practices in light of the new rule.

Ballard Spahr’s Labor and Employment Group frequently advises employers on issues related to whether workers are appropriately classified as employees or independent contractors under the FLSA and other employment laws, including conducting classification audits, and we also defend employers in misclassification litigation. Please contact us if we can assist you with these matters.

Charles Frohman & Denise M. Keyser

CFPB Announces Availability of HMDA Filing Platform for 2023 Data

The CFPB recently announced that the platform for the submission of Home Mortgage Disclosure Act (HMDA) data collected in 2023 is now available for the submission of the data. The platform may be accessed here. HMDA data for 2023 must be submitted on or before March 1, 2024.

A beta testing version of the platform also is available and may be accessed here. HMDA reporting lenders can submit data to the beta testing version of the platform to determine if their data is appropriate for a formal submission of the data to the actual platform. The CFPB advised that no data entered on the beta testing platform will be considered a HMDA submission for compliance with HMDA data reporting requirements.

The CFPB also provided links to the Filing Instructions Guide for HMDA data collected in 2023, and to an Online Loan/Application Register (LAR) Formatting Tool. The Tool is designed to help smaller volume mortgage lenders create an electronic file that can be submitted to the HMDA platform.

FHFA Cites Underutilization of Appraisal Time Adjustments

The Federal Housing Finance Agency (FHFA) recently published a FHFA Insights blog post that cites the underutilization of appraisal time adjustments by appraisers.

The FHFA states that “[i]n principle, appraisers can consider price changes that have occurred since the time the [comparable properties used in the appraisal] sold and make adjustments known as market conditions adjustments or time adjustments. Fannie Mae, Freddie Mac, and Federal Housing Administration appraisal guidelines require such adjustments whenever market conditions have been changing.” The FHFA notes that from 2013 to 2020, the annual rate of appraisals below the contract sales price ranged from 7% to 9% of transactions, the rate spiked to 15% in 2021 and 12% in 2022 (when house prices grew rapidly), and both house price growth and underappraisal rates returned to more typical levels in early 2023.

The FHFA explains that the main dataset used for the blog post is a 5% sample of single-family housing in the Uniform Appraisal Dataset (UAD) that Fannie Mae and Freddie Mac collected covering the third quarter of 2018 through the fourth quarter of 2021. The FHFA also notes that the data includes appraisals conducted with the standard appraisal form (Fannie Mae Form 1004/Freddie Mac Form 70). As a result, the data do not include condominiums, manufactured housing, housing with two or more units, single-family investment properties, and less-than-full appraisals.

The FHFA notes that during the analysis period house prices generally rose, especially in 2021, with annual growth of 5% to 18% percent over this period. The FHFA also notes that while recent sales of comparable properties are commonly used to determine a property’s valuation, comparable sales in the analysis are typically six months old at the time of the appraisal. As a result, the FHFA states that expected time adjustments would range from approximately 2.5% to 9% percent of the sales price, on average, but that during much of the analysis period, appraisers time adjusted fewer than 10% of comparable sales. The FHFA also states that even with the rapid price increases of 2021, time adjustment frequency rose only to about 25%, and that “[w]hile adjustments are not necessarily expected in every case, these rates seem to be considerably lower than local price growth would warrant.” The FHFA also states that it appears time adjustments were unnecessary for, at most, the 36% of properties where the predicted adjustment was between -1 and 2 percent, and that “[t]his result implies that appraisers should have time adjusted 64 percent of [comparable properties], far greater than the 13 percent they actually adjusted.”

The FHFA concludes as follows:

“This blog documents that appraisers underutilize and underestimate time adjustments, but does not attempt to determine the cause or propose potential solutions. One potential reason for underutilization is that these adjustments are some of the more analytically complex calculations appraisers might perform. Also, market information about comparable sales data can be sparse, decentralized, and observed with a lag. The data may also be costly (or at least not always free) and is not always available publicly (which may require paying for access to private databases).”

The FHFA advises that a future blog post will address some of the factors that determine when appraisers choose to time adjust, and examine whether they make time adjustments equitably across neighborhoods.

OCC to Host Public Hearing on Appraisal Bias

The Federal Financial Institutions Examination Council’s Appraisal Subcommittee (ASC) will host a public hearing on appraisal bias on February 13, 2024. This will be the fourth public hearing on appraisal bias, and like the previous hearings, will be hosted by a panel of representatives from each of the FFIEC federal regulatory agencies. Witnesses will discuss topics that align with previous hearings on appraisal bias, including oversight of the appraisal industry, diversity within the appraisal profession, the development and reporting of appraisals, and other challenges that impact appraisals. Previous hearings have included a focus on these issues, as well as appraiser qualifications and training, reconsideration of value, and use of technology in valuation.

The hearing will be held at the Office of the Comptroller of the Currency (OCC) headquarters, and a livestream will also be available to those who register here.

Loran Kilson

CFPB Adjusts Various Penalty Amounts Based on Inflation

The CFPB recently issued a rule to adjust maximum penalty amounts under various statutes that it administers. Included among the adjustments are the amounts for the three tiers of civil money penalties that the CFPB may impose for violations of consumer financial protection laws under the Dodd-Frank Act. Specifically, the Dodd-Frank Act initially provided for the following tiers of civil money penalties:

- For any violation of a law, rule, or final order or condition imposed in writing by the CFPB, a civil money penalty of up to $5,000 for each day during which such violation or failure to pay continues.

- For any person that recklessly engages in a violation of a federal consumer financial law, a civil penalty of up to $25,000 for each day during which such violation continues.

- For any person that knowingly violates a federal consumer financial law, a civil penalty of up to $1,000,000 for each day during which such violation continues.

Based on prior adjustments, the amounts for 2023 were $6,813, $34,065, and $1,362,567, respectively. For 2024, the amounts increase to $7,034, $35,169 and $1,406,728, respectively.

Wisconsin Senate Proposes New Bill to Revise Money Transmission, Consumer Lenders, Collection Agency, and Other Financial Services Licenses

In November 2023, S.B. 668 was introduced in the Wisconsin Senate. S.B. 668 would make sweeping changes to the state laws governing financial service providers. The bill creates a pathway for the Wisconsin Department of Financial Institutions (DFI) to expand use of the Nationwide Multistate Licensing System and Registry (NMLS) across license types, modernizes money transmission laws, and revises the regulation of consumer lenders, collection agencies, check sellers, payday lenders, community currencies exchanges, sales finance companies, adjustment service companies, and insurance premium companies. The bill was read and referred to the Committee on Shared Revenue, Elections and Consumer Protection and a public hearing was held on December 19, 2023.

The 113 page bill further proposes broad changes to financial services licenses as summarized below. Financial service providers operating in Wisconsin should review the bill and contact their legislative representative or one of the bill sponsors to provide input prior to enactment. Ballard’s licensing team can help providers understand how these proposed changes may impact their business operations or help you file for licenses in the NMLS.

Expanded Use of NMLS

Current law limits the DFI’s use of NMLS to mortgage loan originators, mortgage bankers and mortgage brokers. This bill requires DFI to utilize the NMLS with respect to the licensing and regulation of financial services providers, including requiring applicants and licensees to provide information directly to the NMLS and to comply with application and reporting deadlines established by the NMLS. Specifically, the bill requires use of the NMLS system for consumer lenders, money transmitters, collection agencies, payday lenders, community currencies exchanges (check cashers), sales finance companies (companies that acquire motor vehicle installment sales contracts or consumer leases originated by a motor vehicle dealer), adjustment service companies, and insurance premium companies. The expanded use of NMLS is meant to standardize the license renewal process and renewal period for licensed financial services providers.

Money Transmitters and Check Sellers

The bill repeals provisions of current law governing the licensing and regulation of sellers of checks, and replaces them with provisions governing the licensing and regulation of money transmitters, titled the Model Money Transmission Modernization Law, which seeks to implement the Conference of State Bank Supervisors’ Model Money Transmission Modernization Act. The bill incorporates common exceptions, including exceptions for federally insured financial institutions, government agencies, registered securities broker-dealers, agents of a payee that collect and process payments on behalf of the payee if certain conditions are satisfied, electronic funds transfers of governmental benefits by government contractors, employees and authorized delegates of licensed money transmitters if certain conditions are satisfied, and any other person exempted by DFI, as long as the exempt person does not engage in money transmission outside the scope of the exemption. The bill defines money transmission and payment instrument as follows:

- Money transmission means “selling or issuing payment instruments to a person located in this state; selling or issuing stored value to a person located in this state; or receiving money for transmission from a person located in this state.” Money transmission specifically includes payroll processing services that are not performed by the employer (“receiving money for transmission pursuant to a contract with a person to deliver wages or salaries, make payment of payroll taxes to state and federal agencies, make payments relating to employee benefit plans, or make distributions of other authorized deductions from wages or salaries”).

- Payment instrument means “a written or electronic check, money order, traveler’s check, or other written or electronic instrument for the transmission or payment of money or monetary value, whether or not negotiable.” Payment instrument does not include (i) stored value or any instrument that is redeemable by the issuer only for goods or services provided by the issuer or its affiliate or franchisees of the issuer or its affiliate, except to the extent required by applicable law to be redeemable in cash for its cash value or (ii) any instrument that is not sold to the public and is issued and distributed as part of a loyalty, rewards, or promotional program.

The bill’s money transmitter licensing requirements include, among other things:

- Requiring applicants to submit applications and other information through the NMLS;

- Requiring a person or entity seeking control of a money transmitter to apply for a license and meet other conditions;

- Allowing a licensee to conduct business through an authorized delegate, which is a person designated by a licensed money transmitter to engage in money transmission on behalf of the licensed money transmitter; and

- Requiring certain business practices with regards to money transmission, sending receipts, refunding money in some circumstances, submitting audited financials, and maintaining a surety bond, the required net worth and a minimum amount of investments.

Further, the bill provides DFI with various powers relating to the regulation of money transmitters, including investigatory and enforcement powers, including the authority to examine its books, accounts, or records and those of its authorized delegates, and the authority to take possession of an insolvent licensed money transmitter under specified circumstances.

Consumer Lenders

Under current law, a lender (other than a bank, savings bank, savings and loan association, credit union, or any of its affiliates) generally must obtain a license from DFI to assess a finance charge for a consumer loan that is greater than 18% per year. The bill makes numerous changes related to the licensing and regulation of consumer lenders, including the following:

- Defines consumer loan for purposes of licensed lenders (“a loan made by any person to a customer that is payable in installments or for which a finance charge is or may be imposed, and includes transactions pursuant to an open-end credit plan, as defined in s. 421.301(27), other than a seller credit card, as defined in s. 421.301 (41)”);

- Applies to any person who takes an assignment for sale, in whole or in part, of a consumer loan with a finance charge in excess of 18% per year, without regard to whether the loan was originally made by a financial institution; but does not apply to collection agencies, payment processors, and certain persons involved in investment or financing transactions;

- Specifies the activities that require a person to be licensed as a licensed lender: making a consumer loan that has a finance charge in excess of 18% per year; taking an assignment of a consumer loan in which a customer is assessed a finance charge in excess of 18% per year; or directly collecting payments from or enforcing rights against a customer relating to a consumer loan in which a customer is assessed a finance charge in excess of 18% per year;

- Eliminates provisions related to consumer loan interest rates that apply to certain loans entered into before August 1, 1987, and the requirement that all loans must be consummated at the licensed location; and

- Requires a licensed lender to keep its loan records separate and distinct from the records of any other business of the licensed lender.

Collection Agencies

The bill makes numerous changes to the collection agency license provisions, including, among other things:

- Removes the requirement that an individual collector hold a license separate from the license of the collection agency that employs the collector;

- Excludes licensed mortgage bankers and credit unions from collection agency regulation;

- Requires that a separate license be maintained for each business location;

- Expands the reasons for DFI may suspend or revoke a license to include where the collection agency has violated DFI’s rules related to collection agencies, and the collection agency has made a material misstatement, or knowingly omitted a material fact, in an application for a license or in information furnished to DFI or the NMLS;

- Specifies the timing to deposit funds in trust account within 48 hours and submit funds to creditors on the last day of the month following the close of the month during which the collection was effected;

- Permits the use of unsigned collection notices;

- Amends various provisions related to assessing fees to creditors for returning accounts, record retention, identification of trusts accounts, use of “doing business as” names, compliance with federal and state laws, and contracting requirements.

We will continue to monitor the progress of this bill and blog further if the bill is enacted.

Lisa Lanham, Kristen E. Larson & Loran Kilson

The CARS Rule: What You Need To Know About the FTC’s Final Motor Vehicle Dealer Trade Regulation Rule

A Ballard Spahr Webinar | January 23, 2024, 1:00 PM – 2:30 PM ET

Speakers: Alan S. Kaplinsky, John L. Culhane, Jr., Michael R. Guerrero, Brian A. Turetsky

The U.S. Supreme Court’s Decision in the Two Cases Raising the Question of Whether the Chevron Judicial Deference Framework will be Overturned: Who Will Win and What Does It Mean?

A Ballard Spahr Webinar | February 15, 2024, 12:30 PM – 2:00 PM ET

Speaker: Alan S. Kaplinsky

Subscribe to Ballard Spahr Mailing Lists

Copyright © 2025 by Ballard Spahr LLP.

www.ballardspahr.com

(No claim to original U.S. government material.)

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, including electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of the author and publisher.

This alert is a periodic publication of Ballard Spahr LLP and is intended to notify recipients of new developments in the law. It should not be construed as legal advice or legal opinion on any specific facts or circumstances. The contents are intended for general informational purposes only, and you are urged to consult your own attorney concerning your situation and specific legal questions you have.