In This Issue:

- SCOTUS to Reexamine Chevron Deference Framework

- May 4 Podcast Episode: CFSA v. CFPB Moves to the U.S. Supreme Court: A Closer Look at the Constitutional Challenge to the Consumer Financial Protection Bureau’s Funding, With Special Guest, GianCarlo Canaparo, Senior Legal Fellow in The Heritage Foundation's Edwin Meese III Center for Legal and Judicial Studies

- Certiorari Petition to Be Filed in Second Circuit Case Rejecting Constitutional Challenge to CFPB’s Funding

- FDIC Consent Order With Cross River Bank Indicates Heightened Scrutiny of Bank-Fintech Partnerships

- CFPB Issues Proposed Rule on PACE Financing

- CFPB/FTC/DOJ/EEOC Issue Joint Statement on Enforcement Efforts Directed at Discrimination and Bias in Automated Systems; CFPB Announces Plan to Issue Whitepaper on Chatbox Market

- April 27 Podcast Episode: Recent Federal and State Debt Collection Developments

- NYDFS Releases Final Regulations Implementing Virtual Currency Licensee Assessments

- Texas Banking Trade Group and Texas Bank File Lawsuit Challenging Validity of CFPB Section 1071 Final Rule on Small Business Data Collection; Ballard Spahr to Hold June 15 Webinar

- NLRB Seeks Enforcement of Ruling on Separation Agreements

- CFPB and Federal Banking Agencies Issue Joint Statement on LIBOR transition; CFPB Issues Interim Final Rule on Discontinuation of LIBOR

- Fed Implements (Final?) 2023 Interest Rate Hike

- FinCEN Roundup: FY 2022 in Review; First AML Enforcement Against a Trust Company; and Comments to Congress

- North Dakota Enacts Mortgage Lender and Servicer Laws

- CFPB Publishes Data Point on Positive Impacts of Removing Medical Debt Tradelines

- Did You Know?

- Looking Ahead

SCOTUS to Reexamine Chevron Deference Framework

The U.S. Supreme Court has agreed to hear a case in which the petitioners are challenging the continued viability of the Chevron framework that courts typically invoke when reviewing a federal agency’s interpretation of a statute. While Loper Bright Enterprises, et al. v. Raimondo involves a regulation of the National Marine Fisheries Service (NMFS), the Supreme Court’s decision could have significant potential implications for when courts should give deference to regulations issued by all federal agencies, including the CFPB, FTC, and federal banking agencies.

The Chevron framework derives from the Supreme Court’s 1984 decision in Chevron, U.S.A., Inc. v. Nat. Res. Def. Council, Inc. Under the Chevron framework, a court will typically use a two-step analysis to determine if it must defer to an agency’s interpretation. In step one, the court looks at whether the statute directly addresses the precise question before the court. If the statute is ambiguous, the court will proceed to step two and determine whether the agency’s interpretation is reasonable. If it determines the interpretation is reasonable, the court will ordinarily defer to the agency’s interpretation.

The petition for certiorari was filed by four companies that participate in the Atlantic herring fishery. The companies had filed a lawsuit in federal district court challenging a NMFS regulation that requires vessels that participate in the herring fishery to pay the salaries of the federal observers that they are required to carry. The Magnuson-Stevens Act (MSA) authorizes the NMFS to require fishing vessels to carry federal observers and sets forth three circumstances in which vessels must pay observers’ salaries. Those circumstances did not apply to the Atlantic herring fishery.

Applying Chevron deference, the district court found in favor of NMFS under step one of the Chevron framework, holding that the MSA unambiguously authorizes industry-funded monitoring in the herring fishery. The district court based its conclusion on language in the MSA stating that fishery management plans can require vessels to carry observers and authorizing such plans to include other “necessary and appropriate” provisions. While acknowledging that the MSA expressly addressed industry-funded observers in three circumstances, none of which implicated the herring fishery, the court determined that even if this created an ambiguity in the statutory text, NMFS’s interpretation of the MSA was reasonable under step two of Chevron.

A divided D.C. Circuit, also applying the two-step Chevron framework, affirmed the district court. The majority concluded that under step one of Chevron, the statute was not “wholly unambiguous,” and left “unresolved” the question of whether NMFS can require industry to pay the costs of mandated observers. Applying step two of Chevron, the majority concluded that NMFS’s interpretation of the MSA was a “reasonable” way of resolving the MSA’s “silence” on the cost issue.

The Supreme Court granted certiorari to consider the second question presented in the companies’ petition for certiorari. That question is:

Whether the Court should overrule Chevron or at least clarify that statutory silence concerning controversial powers expressly but narrowly granted elsewhere in the statute does not constitute an ambiguity requiring deference to the agency.

In their petition, the companies argue that the majority misapplied Chevron by not concluding that the MSA was unambiguous regarding the NMFS’s authority to require industry funding of mandated observers. They further argue that if the D.C. Circuit decision is consistent with Chevron, the Supreme Court should overrule Chevron or at least clarify its limits, “particularly by explaining that silence does not create ambiguity when the claimed power is granted expressly elsewhere in the statute.” They assert that decades of practice have exposed Chevron’s “many flaws,” which include weakening the judiciary by taking away the courts’ ultimate interpretive authority and encouraging “the executive’s aggrandizement at the expense of the judiciary, Congress, and the citizenry.”

Last Term, in West Virginia et al. v. Environmental Protection Agency et al., the Supreme Court invoked the “major questions doctrine” to strike down an EPA regulation. Many observers view that decision as a step by the Court’s conservative majority towards cutting back on Chevron agency deference.

The U.S. Supreme Court has agreed to review the Fifth Circuit decision in CFSA v. CFPB that held the CFPB’s funding violates the Appropriations Clause of the U.S. Constitution. After reviewing the history of the case from its initial filing to the Supreme Court’s grant of certiorari, we discuss the Fifth Circuit’s interpretation of the Appropriations Clause and the Second Circuit’s conflicting interpretation in its recent decision holding that the CFPB’s funding is constitutional and assess the strength of each interpretation and the reasoning of each decision. We then turn to how the Supreme Court might analyze the case, including how its analysis might differ from that of the Fifth Circuit but still conclude the CFPB’s funding is unconstitutional and whether the views expressed by several of the conservative justices on the “administrative state” are likely to factor into those justices’ interpretations of the Appropriations Clause.

Alan S. Kaplinsky, Senior Counsel in Ballard Spahr’s Consumer Financial Services Group, hosts the conversation.

To listen to the episode, click here.

This is the second podcast episode we have released about this case which has existential importance to the CFPB. In January 2023, we released a two-part episode, “How the U.S. Supreme Court will decide the threat to the CFPB’s funding and structure,” in which our special guest was Adam J. White, a renowned expert on separation of powers and the Appropriations Clause. To listen to the episode, click here for Part I and click here for Part II.

In CFPB v. Law Offices of Crystal Moroney, a three-judge panel of the U.S. Court of Appeals for the Second Circuit unanimously ruled in March 2023 that the CFPB’s funding structure does not violate the Appropriations Clause of the U.S. Constitution and rejected Moroney’s attempt to invalidate the CFPB’s civil investigative demand issued to Moroney. Moroney has now filed a motion with the Second Circuit to stay its mandate pending the filing of a petition for a writ of certiorari by Moroney.

In its decision, the Second Circuit panel expressly declined to follow the Fifth Circuit panel decision in Community Financial Services Association of America Ltd. v. CFPB that reached the opposite conclusion. In February 2023, the Supreme Court granted the CFPB’s certiorari petition seeking review of the Fifth Circuit decision and agreed to hear the case next Term. It seems unlikely that the CFPB will oppose Moroney’s petition and likely that the Supreme Court will grant the petition and either consolidate it for argument with CFSA or hold it pending the outcome in CFSA.

For the reasons discussed in our recent blog post, we believe that the Second Circuit’s opinion will not, in itself, materially impact the ultimate outcome in the Supreme Court and a majority of the Court will conclude that the CFPB’s funding is unconstitutional.

- Alan S. Kaplinsky & Michael Gordon

FDIC Consent Order With Cross River Bank Indicates Heightened Scrutiny of Bank-Fintech Partnerships

The FDIC recently announced that it has entered into a Consent Order with Cross River Bank (CRB or Bank) to resolve FDIC charges that the Bank engaged in unsafe or unsound practices related to its fair lending compliance. (The Consent Order was issued in March 2023 but not made public until the end of last month.) Because the Bank is a “banking as a service provider” that makes loans through numerous partnerships with fintech companies, the Consent Order is widely-considered to be a warning to other banks that their bank-fintech partnerships are likely to receive increased scrutiny from regulators. In addition, while focused on fair lending compliance, many of the requirements imposed on the Bank by the Consent Order are likely to be indicative of FDIC expectations for how banks should be addressing other consumer protection risks associated with bank-fintech partnerships.

Key provisions of the Consent Order require the Bank to:

- Provide the FDIC with a list of each product through which credit is currently being offered by, through, or in conjunction with the Bank (CRB Credit Product) and identify any entity other than the Bank currently offering a CRB Credit Product (Third Party) and the CRB Credit Product(s) it is offering. (“Credit” has the meaning of such term in Regulation B.)

- Obtain the FDIC’s written non-objection before executing a binding commitment or agreement with a new Third Party, allow a New Third Party to offer a Credit Product through or in conjunction with the Bank or offer a New CRB Credit Product, either directly or indirectly. (A “New Third Party” and a “New CRB Credit Product,” are respectively, a Third Party and a CRB Credit Product that is not on the list of current list of Third Parties and CRB Credit Products.)

- Engage an independent, third party acceptable to the FDIC to assess whether the Bank’s Information pertaining to each CRB Credit Product, Third Party, and CRB Credit Model appropriately allows the Bank to determine and monitor whether such CRB Credit Products, Third Parties, and CRB Credit Models comply with applicable fair lending laws and regulations. (“Information” is defined to mean data, documents, records, and any other information in any medium or form. “CRB Credit Model” is defined to mean any models or systems, including any variables or weightings, used or relied on in connection with a CRB Credit Product.) The independent third party must also assess whether the Bank’s Information Systems allow the Bank to access, collect, and analyze the Information necessary to appropriately monitor, in a timely manner, each CRB Credit Product, every Third Party, and any CRB Credit Models and ensure that each such CRB Credit Product is offered, and every Third Party and CRB Credit Model operates, in compliance with applicable fair lending laws and regulations. (“Information Systems” is defined to mean the networks, systems, devices, software, hardware and other information resources, tools, mechanisms, and/or compensating controls used by the Bank to collect, process, maintain, use, share, disseminate, or dispose of Information pertaining to a CRB Credit Product, Third Party, or CRB Credit Model.)

- Conduct a risk assessment of all CRB Credit Products and Third Parties on the current lists to identify fair lending risks, including any risk associated with an “application” or “Credit Transaction” as defined in Regulation B, conducted by, through, or in conjunction with the Bank, and engage an independent, third party acceptable to the FDIC to conduct a fair lending resources study. The study must consider (i) the Bank’s size and growth plans; (ii) the current and anticipated number of CRB Credit Products and respective volumes, Third Parties, and merchants offering one or more CRB Credit Products through or in conjunction with a Third Party; (iii) the volume of decisions made by the Bank or on behalf of the Bank by a Third Party in conjunction with an application, including Credit underwriting practices, a CRB Credit Transaction, or any CRB Decisions; and (iv) the Bank’s use of non-staff resources, including software, automated systems and other technology. (“CRB Decisions” are decisions made in connection with the marketing of a CRB Credit Product, including the terms and conditions described in the marketing of a CRB Credit Product.) The independent third party’s report must identify any non-staff fair lending resource needs and enhancements recommended to ensure fair lending compliance, identify the type and number of mangers needed to supervise bank staff responsible for fair lending compliance, and identify the type and number of bank staff positions needed for compliance with the Consent Order and fair lending compliance.

- Develop fair lending internal controls that must be reviewed periodically on a risk basis but not less than annually and adjusted appropriately. The controls must include fair lending policies and procedures designed to (i) address and mitigate any risks identified in the fair lending assessment, (ii) require appropriate oversight and monitoring of all decisions made in connection with the marketing of a CRB Credit Product, including the terms and conditions described in the marketing of a CRB Credit Product, (iii) ensure fair lending compliance, and identify statistically significant disparities involving a prohibited basis (as defined in Regulation B). The policies and procedures must determine whether disparities are the result of acts or practices that do not comply with fair lending laws and regulations and determine appropriate corrective or remedial action and mitigation steps to prevent recurrences. The controls must also provide for fair lending training for Board members and managers and personnel with roles and responsibilities related to CRB Credit Products and must provide for satisfactory monitoring of CRB Decisions, Credit Products, and Third Parties for fair lending compliance. The Consent Order lists detailed minimum requirements for training and monitoring.

- Engage an independent, third party acceptable to the FDIC to assess the fair lending compliance of each Third Party offering a CRB Credit Product for a period of six months or more during a designated time frame. The Bank must develop a written plan for addressing any recommendations in the independent third party’s report of actions to be taken where a Third Party is not in compliance with fair lending laws and regulations.

- Develop policies and procedures to conduct periodic, but not less than annual, assessments of whether each Third Party offering CRB Credit Products for a period of more than six months during a calendar year preceding the assessment offered the products in compliance with fair lending laws and regulations. The Bank must also develop third party compliance internal controls that include policies and procedures designed to ensure fair lending compliance by Third Parties. The detailed minimum requirements for such policies and procedures are set forth in the Consent Order and include due diligence requirements for new Third Parties and new CRB Credit Products.

- Ronald K. Vaske, John L. Culhane, Jr. & Richard J. Andreano, Jr.

CFPB Issues Proposed Rule on PACE Financing

The Economic Growth, Regulatory Relief, and Consumer Protection Act (Act) directs the CFPB to prescribe Truth in Lending Act (TILA) ability-to-repay (ATR) rules for Property Assessed Clean Energy (PACE) financing. The CFPB recently issued a proposed rule that would require PACE creditors and PACE companies to consider a consumer’s ability to repay when issuing a new PACE loan, amend Regulation Z to address how it applies to PACE transactions, and adjust disclosure requirements to better fit PACE loans. Comments must be received by the later of July 26, 2023, or 30 days after the date the proposal is published in the Federal Register.

As explained in our previous blog, PACE financing is defined as financing to cover the costs of home improvements that result in a tax assessment on the real property of the consumer. In the proposed rule, the CFPB states that these loans differ from other loans traditionally covered under Regulation Z because they impact tax liability for consumers, they create a priority lien attached to the consumer’s home, they are typically higher cost loans, and many PACE borrowers are already making payments on an existing mortgage loan. The Bureau acknowledges that PACE financing is not new and there are existing state laws that cover them.

In the proposal, the CFPB focuses on amendments made to California’s consumer protection laws that require a PACE administrator to make a determination that the consumer has a reasonable ability to meet the annual payment obligations based on the consumer’s income, assets, and current debt obligations. The Bureau also discusses California’s financial disclosures prior to consummation; three-day right to cancel, which is extended to five days for older adults; mandatory confirmation-of-terms calls; and restrictions on contractor compensation.

The proposed amendments to Regulation Z include, among other things:

- Clarification that the commentary’s exclusion to “credit,” as defined in § 1026.2(a)(14), for tax liens and tax assessments applies only to involuntary tax liens and involuntary tax assessments;

- Requirement that the consumer be provided with modified versions of the Loan Estimate and Closing Disclosure. The modifications including the removal of escrow related fields, a requirement that PACE and other property tax obligations be identified separately, and a requirement that the PACE company be identified;

- Exceptions for PACE loans from requirements to establish escrow for higher-priced mortgage loans;

- Application of Regulation Z’s ATR requirements in section 1026.43 to PACE transactions with a number of adjustments, including that such transactions are not eligible to be qualified mortgages; and

- Extension of the ATR requirements and the liability provisions of TILA section 130 to any “PACE company.”

The Bureau published a Fast Facts document outlining the proposed amendments to Regulation Z.

- Richard J. Andreano, Jr. & Loran Kilson

The CFPB, FTC, Justice Department, and Equal Employment Opportunity Commission have issued a joint statement about enforcement efforts “to protect the public from bias in automated systems and artificial intelligence.” The CFPB also issued a separate press release and prepared remarks by Director Chopra about the statement. In the press release, the CFPB indicated that it “will release a white paper this spring discussing the current chatbot market and the technology’s limitations, its integration by financial institutions, and the ways the CFPB is already seeing chatbots interfere with consumers’ ability to interact with financial institutions.”

In the joint statement, the term “automated systems” is used to mean “software and algorithmic processes, including [artificial intelligence], that are used to automate workflows and help people complete tasks or make decisions.” The agencies observe in the statement that “[p]rivate and public entities use these systems to make critical decisions that impact individuals rights and opportunities, including fair access to a job, housing, credit opportunities, and other goods and services.” Giving minimal acknowledgment to the benefits of automated systems, the statement focuses on their “potential to perpetuate unlawful bias, automate unlawful discrimination, and produce other harmful outcomes.” The agencies “reiterate their resolve to monitor the development and use of automated systems and promote responsible innovation,” and also “pledge to vigorously use [their] collective efforts to protect individual rights regardless of whether legal violations occur through traditional means or advanced technologies.”

The statement lists the following sources of potential discrimination in automated systems:

- Unrepresentative or imbalanced datasets, datasets that incorporate historical bias, or datasets that contain other types of errors can skew automated system outcomes. Automated systems also can correlate data with protected classes, which can lead to discriminatory outcomes.

- A lack of transparency regarding the internal workings of automated systems that causes them to be “black boxes” and makes it difficult for developers, businesses, and individuals to know whether an automated system is fair.

- The failure of developers to understand or account for the contexts in which their automated systems will be used, and the designing of systems based on flawed assumptions about their users, relevant context, or the underlying practices or procedures they may replace.

The joint statement includes a description of each agency’s authority to combat discrimination and identifies pronouncements from each agency related to automated systems. In its press release, the CFPB describes “a series of CFPB actions to ensure advanced technologies do not violate the rights of consumers.” Notably, the CFPB includes among such actions its policy statement on abusive acts or practices and its proposal to require nonbanks to register when, as a result of settlements or otherwise, they become subject to orders from local, state, or federal agencies and courts involving violations of consumer protection laws. With regard to its policy statement on abusive acts or practices, the CFPB states that the prohibition on abusive conduct “would cover abusive uses of AI technologies to, for instance, obscure important features of a product or service or leverage gaps in consumer understanding.” With regard to the proposed registry, the CFPB states that it “would allow the CFPB to track companies whose repeat offenses involved the use of automated systems.”

Consistent with past remarks, Director Chopra used his prepared remarks to highlight the “threat” posed by AI in the form of “unlawful discriminatory practices perpetrated by those who deploy these technologies.” Although not addressed specifically in the joint statement, Director Chopra raised concerns about generative AI. He stated that generative AI “which can produce voices, images, and videos that are designed to simulate real-life human interactions are raising the question of whether we are ready to deal with the wide range of potential harms – from consumer fraud to privacy to fair competition.” (We recently released an episode of our Consumer Finance Podcast in which we focused on generative AI.)

- John L. Culhane, Jr. & Michael Gordon

April 27 Podcast Episode: Recent Federal and State Debt Collection Developments

Third-party debt collectors, first-party creditors, and debt buyers face an ever-evolving federal and state regulatory landscape as well as ongoing private litigation. We first look at the impact of the CFPB’s most recent rulemaking agenda on debt collectors. We then discuss compliance and licensing issues under District of Columbia, California, Utah, and New York debt collection laws and the Wyoming “debt buyer” licensing requirement. We conclude with a discussion of 2022 debt collection litigation statistics and state law developments related to the collection of student loans, including the California Student Loan Collections Reform Act.

Alan S. Kaplinsky, Senior Counsel in Ballard Spahr’s Consumer Financial Services Group, hosts the conversation joined by Lisa M. Lanham and John L. Culhane, Jr., partners in the Group, and Abigail S. Pressler, Of Counsel in the Group.

To listen to the episode, click here.

NYDFS Releases Final Regulations Implementing Virtual Currency Licensee Assessments

On April 17, the NYDFS announced the adoption of final regulations intended to shift the cost of supervision and examination of BitLicensees from the NYDFS via the implementation of direct assessments to licensees. The new regulations will primarily only apply to those entities who hold a BitLicense, as entities engaging in virtual currency business activities as a limited purpose trust company or a banking organization will continue to be assessed under 23 NYCRR Part 101.

Under the new regulations, entities who conduct virtual currency activities will receive five assessments from the NYDFS throughout the course of the year, with the first four assessments occurring on a quarterly basis. These assessments will be tied to the anticipated sum of the NYDFS’ total operating expenses solely attributable to its oversight of Licensees, along with a portion of the NYDFS’ operating expenses. The final assessment will be a “true-up,” based upon the actual total operating cost. Once an assessment is issued, an entity will have 30 days in which to pay.

Lastly, the regulations give the NYDFS Superintendent the ability to issue special assessments in relation to a specific examination, investigation, or review, when it is determined that those costs are best allocated solely to the individual licensee. In making a determination regarding whether or not a special assessment is warranted, the Superintendent will look to factors including:

- The significance of the examination to the conduct of business by a given Licensee or group of Licensees;

- The potential seriousness of any violations of law or regulation identified by, or under review in, such examination or investigation; and

- The extent to which a Licensee attempted to cover up or failed to disclose the existence of such violations.

A copy of the final regulations can be found here.

- Lisa Lanham & John Georgievski

While it has only been a month since the CFPB issued its final rule to implement Section 1071 of the Dodd-Frank Act, the CFPB is already facing a lawsuit challenging the rule’s validity. The lawsuit was filed last week in a Texas federal district court by the Texas Bankers Association and Rio Bank, McAllen, Texas. It is not surprising that the lawsuit was filed in the Fifth Circuit, given that it was a Fifth Circuit panel that held the CFPB’s funding is unconstitutional in Community Financial Services Association of America Ltd. v. CFPB. (The U.S. Supreme Court has agreed to review the decision in its next Term.)

On Thursday, June 15, 2023, from 12:00 p.m. to 1:00 p.m. ET, Ballard Spahr will hold a webinar, “An Even Deeper Dive into the CFPB’s Final Section 1071 Rule on Small Business Data Collection.” The webinar is a follow-up to our April webinar on the rule that had record-breaking attendance. We received many excellent questions from attendees and will be providing answers to those questions in the June webinar. To register for the June webinar, click here.

The complaint describes Rio Bank as a Minority Depository Institution whose Board of Directors is a majority Hispanic and whose market is approximately 90% to 95% Hispanic. The bank is further described as having approximately $900 million in total assets with 14 locations in the Rio Grande Valley and 200 employees. The bank alleges that it makes small business and agricultural loans to small businesses in the Valley and that it made 409 small business and agricultural loans in a total amount of $117 million in 2022.

The complaint alleges that the 1071 rule is invalid because the CFPB’s funding structure is unconstitutional and because portions of the rule also violate various requirements of the Administrative Procedure Act (APA). The plaintiffs’ constitutional argument is that because the CFPB’s funding structure violates the Appropriations Clause, the rule is invalid and should be vacated (citing to the Fifth Circuit ruling in the CFSA case.)

The plaintiffs make the following arguments regarding the APA:

- The CFPB abused its discretion by promulgating a rule beyond the statutory scope. While Section 1071 directs financial institutions to collect and report 13 specific data points, the final rule sets forth 81 separate data or sub-data points (representing an enlargement of the requisite data points by over 600 percent.) These additional data or sub-data points were added without any basis in the administrative record. Rather than advancing the Dodd-Frank Act’s goal of increasing the number of loans made to minority and women-owned businesses, the final rule will undermine that purpose. This is because many banks cannot afford the costs of complying with the rule’s burdensome requirements. As a result, banks will abandon small business lending and there will be fewer banks willing to participate in the small business lending space. Due to this violation, all data points in excess of the 13 specified in Dodd-Frank should be invalidated and set aside.

- The CFPB acted arbitrarily and capriciously by failing to consider comments. In comments submitted on the proposed Section 1071 rule, the CFPB was alerted to the alarming costs that the expansion of data points would impose on small and mid-sized banks. The CFPB failed to consider and respond to these comments and there is no support in the administrative record for a determination that the additional data would aid in fulfilling the purpose of Dodd-Frank to encourage additional lending. Due to this violation, the entire rule should be invalidated and set aside.

- The CFPB acted arbitrarily and capriciously by failing to undertake a proper cost/benefit analysis. The CFPB failed to account for the disproportionate cost of the final rule on small banks (which make the most small business loans) and the fact that the final rule would likely decrease the availability of loans to women and minority-owned businesses. Due to this violation, the entire rule should be invalidated and set aside.

- Richard J. Andreano, Jr. & John L. Culhane, Jr.

NLRB Seeks Enforcement of Ruling on Separation Agreements

The focus remains on the National Labor Relations Board’s (Board or NLRB) ruling in February that asking employees to sign separation agreements with confidentiality and non-disparagement clauses is unlawful. Most recently, the Board urged the Sixth Circuit to enforce its February 21, 2023, decision in McLaren Macomb and Local 40 RN Staff Council, Office and Professional Employees, International Union (OPEIU), AFL-CIO, which found that the company had violated Section 8(a)(1) of the National Labor Relations Act (NLRA) when it offered a separation agreement to 11 furloughed bargaining members that included a broad non-disparagement provision and a provision treating the agreement as confidential.

Additional information regarding the NLRB’s McLaren decision can be found in Ballard Spahr’s previous posts on the matter: NLRB Establishes New Restrictions on Severance Agreements (published February 22, 2023), and NLRB General Counsel Issues Guidance Regarding Restrictions on Severance Agreements (published March 23, 2023).

The determination found that “[a]greements that contain broad proscriptions on employee exercise of Section 7 rights,” such as the non-disparagement provision in McLaren’s agreement, unlawfully “purport to create an enforceable legal obligation to forfeit [Section 7] rights.” The Board further held that prior tests meant to distinguish between enforceable and non-enforceable non-disclosure agreements, such as those set forth by the Board in its International Game Technology decision, failed to recognize the chilling effect any non-disparagement clause has on a member’s exercise of Section 7 rights and, as such, were insufficient. The Board’s McLaren decision effectively overrules the Board’s position set forth in its Trump-era opinions in the matters of Baylor University Medical Center and International Game Technology, which found non-disparagement clauses lawful unless the provision had a “reasonable tendency” to restrain a worker’s exercise of their rights under Section 7 of the NLRA.

Pursuant to federal law, the NLRB may apply to the appropriate federal appellate court to enforce any of its decisions. 29 U.S.C. § 160(e). McLaren Macomb is headquartered in Mt. Clemens, Michigan, necessitating filing the McLaren enforcement application with the United States Court of Appeals for the Sixth Circuit. While the filing of an application for enforcement is not required, statements made by Shela Khan Monroe, Vice President of Labor and Employment Relations at McLaren Health Care, give some indication the application is non-controversial and perhaps expected in this matter, explaining the application “is a typical step taken by the [NLRB] as it lacks the power to enforce its own decisions.” There is no indication that McLaren Macomb has sought to appeal the NLRB’s determination, or that the Board’s determination is otherwise stayed pending an order from the Sixth Circuit.

Employers should review their separation agreement templates to determine whether they comport with the latest ruling and guidance from the Board. Ballard Spahr’s Labor and Employment Group regularly advises clients on matters concerning the NLRA, preparing separation agreements, and the intersection of these issues.

- Brian D. Pedrow & Jennell Shannon

Last week, the CFPB, together with the Federal Reserve Board (Board), FDIC, OCC, and NCUA, issued a “Joint Statement on Completing the LIBOR Transition.” The agencies issued the statement to remind supervised institutions that LIBOR will be discontinued on June 30, 2023, and to reiterate their expectations that institutions with LIBOR exposure should complete their transition of remaining LIBOR contracts as soon as possible. The agencies encourage institutions to ensure that replacement alternative rates are negotiated where needed and in place by June 30, 2023 for all LIBOR-referencing contracts including investments, derivatives, and loans. They remind institutions that (1) safe and sound practices include conducting the due diligence necessary to ensure that alternative rates are appropriate for the institution’s products, risk profile, risk management capabilities, customer and funding needs, and operational capabilities, and (2) due diligence should include having an understanding of how a chosen alternate rate is constructed and what fragilities, if any, are associated with that rate and the markets underlying it.

In the joint statement, the agencies note Congress’s enactment of the LIBOR Act to provide a uniform, nationwide solution for replacing references to LIBOR in existing contracts with no or inadequate fallback provisions, meaning no or inadequate contract provisions for determining an alternative reference rate. In addition, they note the final rule issued by the Board in January 2023 to implement the LIBOR Act. The rule establishes default rules for benchmark replacements in certain contracts that use LIBOR as a reference rate.

Concurrently with the issuance of the joint statement, the CFPB issued an interim final rule amending and updating the CFPB’s December 2021 final rule that amended Regulation Z and the Official Staff Commentary to address the discontinuation of LIBOR. (The December 2021 final rule became fully effective on October 1, 2022.) Before the amendments, Regulation Z’s open-end credit provisions only allowed HELOC creditors and card issuers to change an index and margin used to set the APR on a variable-rate account when the original index “becomes unavailable” or “is no longer available” and certain other conditions are met. Having determined that all parties would benefit if creditors and issuers could replace a LIBOR-based index before LIBOR becomes unavailable, the CFPB’s final rule added a new provision that allows HELOC creditors and card issuers (subject to contractual limitations) to replace a LIBOR-based index with a replacement index and margin on or after April 1, 2021, including an index based on the Secured Overnight Financing Rate (SOFR). The replacement index must be either an established index with a history or a newly established index with no history. An established index with a history may only be used if the index’s historical fluctuations are substantially similar to those of the LIBOR index.

For closed-end credit, Regulation Z provides that a refinancing subject to new disclosures results if a creditor adds a variable-rate feature to a closed-end credit product but that a variable-rate feature is not added when a creditor changes the index to one that is “comparable.” The CFPB’s final rule added new commentary that provides examples of the types of factors to be considered in determining whether a replacement index is a “comparable” index to a particular LIBOR-based index.

The December 2021 final rule included the Bureau’s determinations that (1) the prime rate published in the Wall Street Journal has historical fluctuations substantially similar to those of the 1- and 3-month U.S. Dollar LIBOR indices, and (2) the spread-adjusted indices based on the SOFR recommended by the Alternative Reference Rates Committee (ARRC) to replace the 1-, 3-, and 6-month U.S. Dollar LIBOR indices have historical fluctuations substantially similar to those of the 1-, 3-, and 6-month U.S. Dollar (USD) LIBOR indices. The CFPB reserved judgment on whether it would identify a SOFR-based index as comparable to the 12-month LIBOR index, indicating that it would consider whether to issue a supplemental final rule on replacements to the 12-month LIBOR index after reviewing the ARRC’s recommendations for a replacement rate. The ARRC subsequently recommended the use of the 12-month term SOFR rate to replace 12-month LIBOR rate and in its final rule, the Board selected the indices based on SOFR recommended by the ARRC for consumer products for 1-month, 3-month, 6-month and 12-month USD LIBOR indices as the benchmark replacements for LIBOR contracts that are consumer loans (the “Board-selected benchmark replacements”).

In its discussion of the interim final rule, the CFPB states that the enactment of the LIBOR Act and the Board’s final rule resolved the ambiguity that existed at the time the CFPB issued its December 2021 final rule as to which, if any SOFR-based replacement index for the 12-month LIBOR index would meet the standards that it be a “comparable” index and have “historical fluctuations substantially similar” to the LIBOR index it replaces. It also states that by operation of the LIBOR Act, all of the Board-selected benchmark replacements constitute a “comparable index” to, and have “historical fluctuations that are substantially similar to” the LIBOR indices they replace.

Accordingly, the interim final rule makes changes to the CFPB’s December 2021 final rule that are intended to conform the December 2021 final rule’s terminology and substantive provisions with the LIBOR Act and Board final rule. For example, the interim final rule replaces references to the “index based on SOFR recommended by the Alternative Reference Rates Committee for consumer products” with a reference to the “Board-selected benchmark replacement rate for consumer loans.” It also removes the CFPB’s determinations concerning the comparability of, and the substantial similarity of the historical fluctuations of, the spread-adjusted indices based on the SOFR recommended by the ARRC for consumer products compared to the LIBOR indices they would replace. The CFPB states that these determinations were “rendered obsolete” by the LIBOR Act and the Board’s final rule. In removing the CFPB’s determinations, the interim final rule makes various changes to the December 2021 final rule to reflect that the LIBOR Act represents a Congressional determination that all of the Board-selected benchmark replacements constitute a “comparable index” to, and have “historical fluctuations that are substantially similar to,” the LIBOR indices they replace.

Comments on the CFPB’s interim final rule must be received no later than 30 days after the date it is published in the Federal Register.

- Richard J. Andreano, Jr. & John L. Culhane, Jr.

Fed Implements (Final?) 2023 Interest Rate Hike

In a continued effort to reduce inflation to its 2 percent target, the Federal Reserve on Wednesday raised the benchmark interest rate another quarter-point, setting it between 5 and 5.25 percent, a 16-year high.

At the Federal Reserve’s post-meeting press conference, Federal Reserve Chair Jerome Powell was careful to state that the Federal Open Market Committee (FOMC) had not yet made a decision to “pause” its campaign to slow the growth of inflation by increasing interest rates.

“The labor market remains very tight,” he noted.

The Federal Reserve’s post-meeting statement did, however, notably not include a comment contained in its March statement that the central bank “anticipates that some additional policy firming may be appropriate” for the Fed to achieve its 2 percent inflation goal.

The FOMC “will be driven by incoming data, meeting by meeting,” Chair Powell said.

This latest announcement marks the tenth consecutive increase by the Federal Reserve; that’s the highest number of consecutive rate hikes on record. The campaign to get inflation under control by raising interest rates over the last 13 months has taken its toll on the economy, dampening markets and forcing companies, consumers, and investors to grapple with higher borrowing costs.

Corporate debt defaults reached the highest they have been since 2009, and many experts predict that, by the end of the year, loan default rates will rise to more than 4 percent—double where they are now, providing an opportunity to acquire distressed assets at bargain prices. Sectors with higher-than-average default rates include retail, telecommunications, broadcast and media, and leisure and entertainment.

Fueled by the remote work situations brought about by the pandemic, office and retail space valuations fell by roughly 15 percent in March. Mortgages secured by office properties are particularly vulnerable, with distressed commercial real estate loans having risen to 5.2% in February.

Further increasing the likelihood of default rates on commercial mortgages is last weekend’s collapse of another substantial bank, the third major bank to fail in the last two months. Bank closures of this magnitude tend to influence many banks and other capital providers to cut back on lending and the purchase of mortgage-backed securities, a development that in turn can add further challenges for refinancing a wave of commercial mortgage loans scheduled to mature over the next several years.

This increasing threat of a recession and increased unemployment caused lawmakers, including Sen. Elizabeth Warren (D-MA) and Rep. Pramila Jayapal (D-WA), to draft a letter to Chair Powell on Monday, urging the Federal Reserve to pause additional rate hikes.

Ballard Spahr's multidisciplinary Distressed Assets and Opportunities team is helping clients navigate an economy where the cost of capital is likely to continue to increase and its availability may become further constrained, creating both challenges and opportunities. Please contact us if you have questions or would like to learn more about the team.

- Dominic J. De Simone, Matthew G. Summers, & Brian Schulman

Last week, FinCEN “communicated,” so to speak, to private industry, law enforcement, regulators, and legislators in three very different ways: through a FY 2022 Year In Review infographic; a first-of-its kind enforcement action against a trust company; and in statements before the U.S. House of Representatives. This post summarizes each of these developments, which are unified by the motif of FinCEN asserting that it has an increasing role in protecting the U.S. financial system against money laundering, terrorist financing and other illicit activity; providing critical data and analytical support to law enforcement agencies pursuing these goals; and simultaneously policing and trying to collaborate with private industry regarding these goals.

FinCEN Year in Review for FY 2022

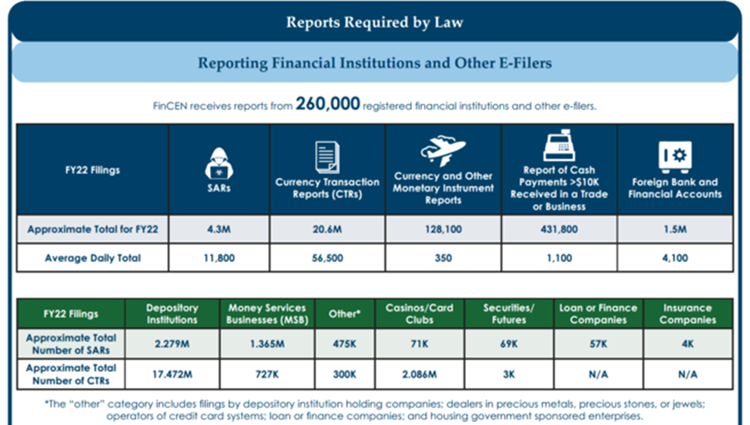

First, on April 25, FinCEN issued its Year in Review for FY 2022, an infographic touting FinCEN’s accomplishments, Bank Secrecy Act (BSA) filings by financial institutions and their subsequent use by law enforcement, information sharing under Sections 314(a) and 314(b), and other topics. The Review sets forth a lot of statistics and factoids, which are often interesting, even if they sometimes lack context. Here are a few items of particular note:

- IRS-Criminal Investigation is a key consumer of BSA reports filed by financial institutions (FIs) – i.e., Suspicious Activity Reports (SARs) and Currency Transaction Reports (CTRs). Over 83% of IRS-CI investigations recommended for prosecution during FY 2020 to FY 2022 involved a primary subject referenced by a related BSA filing. Perhaps more importantly, because the following involves “investigative leads” initiating investigations (vs. special agents in ongoing investigations searching FinCEN’s BSA filing database for any “hits” on previously-identified subjects), almost 16% of all IRS-CI investigations “were the direct result of BSA data.”

- The Department of Justice “has run millions of queries in the past six years.” [Nonetheless, and as we have blogged, the DOJ apparently has been incapable of indicating what BSA filings it actually finds valuable, despite a statutory requirement to do so.]

- Further, “[t]he top 10 filers of SARs filed approximately 52% of all FY22 SARs.” As noted below, 260,000 FIs are registered to e-file BSA reports with FinCEN. That means that 10 FIs filed approximately 2.24 million SARs – an average of 224,000 SARs per FI. The other 259,990 FIs filed the other 2.06 million SARs – an average of under 8 SARs per FI. Further, this latter average is almost surely skewed by many FIs that file perhaps one or two SARs annually. A remarkable divergence. Bottom line: a few large FIs (banks) routinely file a staggering sum of SARs, likely due to so-called “defensive filing” behavior resulting in over-filing to try to avoid regulatory blowback. Conversely, smaller FIs, lacking the same resources, personnel, sophisticated compliance programs, and/or conservative risk appetite, potentially under-file SARs.

- 14,800 FIs participated in the Section 314(a) information sharing program, which enables law enforcement, through FinCEN, to obtain information from FIs regarding the accounts and transactions of persons potentially involved in money laundering and terrorist financing. Further, over 7,600 FIs participated in the Section 314(b) information sharing program, which enables FIs to share information with each other regarding the same topics. 4,427 of these FIs were banks or credit unions, and 1,725 were broker-dealers. Thus, only a few of the other types of FIs (money transmitters, casinos, etc.) participated. These numbers should be considered in light of the number of FIs referenced in the below infographics: 260,000 FIs are registered to e-file BSA reports with FinCEN. So, it is unclear whether the Section 314 programs are operating to their full potential.

- FinCEN issued three Advisories and three Alerts in FY 2022 regarding various money laundering and terrorist financing threats, inviting FIs to file SARs referencing the relevant Advisory or Alert. FinCEN’s Alert on Elder Exploitation garnered 19,395 SAR references. The others were not even close: second place goes to FinCEN’s Alert on Potential Russian Sanctions Evasion Attempts, which garnered 923 SARs.

Finally, the amount of BSA filings continues to explode. Over 4 million SARs are now filed annually, and over 20 million CTRs. These two infographics say it all:

First Enforcement Action Against a Trust Company

On April 26, FinCEN announced a Consent Order imposing a $1.5-million civil penalty against Kingdom Trust Company (Kingdom Trust) for alleged BSA violations – the first-ever BSA enforcement action against a trust company.

According to FinCEN’s press release, “Kingdom Trust admits that it willfully failed to accurately and timely report hundreds of transactions to FinCEN involving suspicious activity by its customers, including transactions with connections to a trade-based money laundering scheme and multiple securities fraud schemes that were the subject of both criminal and civil actions. These failures stemmed from Kingdom Trust’s severely underdeveloped process for identifying and reporting suspicious activity.”

Kingdom Trust is located in Murray, Kentucky and organized under the laws of the state of South Dakota. It therefore is considered a “bank,” as defined and regulated by the BSA. The Consent Order – typical of FinCEN – is very detailed, and we summarize its allegations greatly.

Kingdom Trust provides custody services to individuals with IRAs, and acts as a qualified custodian for investment advisers. However, during the time period at issue of February 2016 through March 2021, it also “engaged in the business of providing account and payment services to foreign securities and investment firms as well as other businesses – including money services businesses – located in Latin America that had elevated risks of money laundering.” Key to understanding the Consent Order is the allegation that Kingdom Trust facilitated at least $4 billion in payments through the United States by such customers, “with minimal oversight.”

According to the Consent Order, Kingdom Trust’s process for filing SARs was “severely underdeveloped and ad hoc,” resulting in a willful failure to file timely and accurate SARs. Adequate and experienced AML compliance staffing was also an issue, and the company relied on a manual review of daily transactions by a single employee to identify potentially suspicious transactions. Very few SARs were filed. This “process” was inadequate and resulted in the failure to file hundreds of timely and accurate SARs.

Further, the company’s direction to all employees to alert and report any potentially suspicious activity to compliance personnel – although good in theory – was almost always ignored or misunderstood in practical application, because company employees (including compliance personnel) did not understand how potential red flags listed in written policies actually could apply to Kingdom Trust customers.

After other financial institutions began closing Kingdom Trust’s accounts, the company engaged a third party to conduct a BSA/AML audit. Although the audit cited specific deficiencies, “Kingdom Trust did not exit the high-risk Latin American customers, make meaningful changes to its controls, or file any SARs related to this ongoing business line.”

Ultimately, it is reasonably to ask why such a relatively “limited” monetary penalty was imposed, given the scope of the alleged misconduct and the $4 billion figure referenced repeatedly. Part of the answer may be that Kingdom Trust invested in AML compliance by hiring an independent consultant, an outside law firm, and a new AML compliance officer with relevant experience, and by implementing an automated transaction monitoring system and increasing the size of its AML compliance staff. However, perhaps the primary answer is contained in a terse footnote, offered with no further details: after receiving inquiries from law enforcement about problematic accounts, “Kingdom Trust did, however, provide cooperation to law enforcement regarding many of the relevant accounts.”

Comments Before Congress – With a Focus on the CTA

Finally, FinCEN Acting Director Himamauli Das appeared on April 27 before the Committee on Financial Services of the U.S. House of Representatives. His prepared comments are here.

Here are some nuggets extracted from his comments, which are understandably high-level:

- FinCEN is focused on implementing the Corporate Transparency Act (CTA) and the database necessary to house the many millions of reports regarding beneficial ownership information (BOI) by entities covered by the CTA. Acting Director Das asserted that he is “confident” that “we remain on track for implementation in January [2024].” Nonetheless, such implementation is a “hugely resource-intensive process.” Moreover, FinCEN is well aware of the intense and widespread criticism of its proposed CTA BOI reporting form, and is “carefully considering the comments[.]” In other words, FinCEN is going to revise the proposed CTA BOI reporting form and make it more demanding.

- FinCEN is undergoing an audit by the Department of the Treasury’s Acting Inspector General regarding data protection and FinCEN’s ability to securely share BSA information with other components of the government. “. . . . FinCEN has already implemented several measures in response to OIG feedback, in order to ensure that sensitive information is protected appropriately, both in the context of BSA information and in designing the beneficial ownership framework and associated policies and procedures prior to receiving [BOI reporting under the CTA] next year.”

- FinCEN is attempting to improve “feedback loops“ with private industry regarding BSA reporting by financial institutions and what sort of reports are actually valuable to law enforcement and regulators – an evergreen topic.

- FinCEN is prioritizing BSA violations by the virtual currency industry.

- FinCEN is ramping up its Office of the Whistleblower, which “holds tremendous potential as a force-multiplier for the entire federal government[,]” and is developing a more formal tip intake and award certification system.

- FinCEN is providing data and analysis to OFAC and other arms of the federal government to assist in the imposition of sanctions relating to Russia, and efforts to detect, disrupt and prosecute efforts to evade those sanctions.

- FinCEN is supporting government-wide efforts to combat ransomware attacks.

If you would like to remain updated on these issues, please click here to subscribe to Money Laundering Watch. To learn more about Ballard Spahr’s Anti-Money Laundering Team, please click here.

On April 12, North Dakota Governor Doug Burgum signed into law House Bill 1068, which creates a new statutory licensing scheme in North Dakota covering residential mortgage loan servicing activities. This follows on the heels of the enactment last month of North Dakota Senate Bill 2090, which overhauled North Dakota’s licensing requirements related to residential mortgage lending. Both licenses will be enforced by the North Dakota Department of Financial Institutions and are effective as of August 1, 2023.

Residential Mortgage Lending

Senate Bill 2090 shifts the applicable license-type for conducting residential mortgage lending from the existing North Dakota Money Broker License to a new Residential Mortgage License. Existing Money Broker Licensees are not required to hold the new Residential Mortgage License until December 31, 2023, a limited extension to the law’s general effective date of August 1, 2023. The entities exempt from the requirement to hold a Residential Mortgage License include banks, credit unions, savings and loan associations, trust companies, and certain nonprofits.

The Residential Mortgage License will require licensees to hold a surety bond of at least $50,000; maintain a minimum net worth of $25,000; file call reports via the NMLS; and refrain from net branching arrangements. Further, the statue will require the following language to be in written contracts (in capital letters):

NOTICE: RESIDENTIAL MORTGAGE LENDERS ARE LICENSED AND REGULATED BY THE NORTH DAKOTA DEPARTMENT OF FINANCIAL INSTITUTIONS. THE DEPARTMENT OF FINANCIAL INSTITUTIONS HAS NOT PASSED ON THE MERITS OF THE CONTRACT AND LICENSING DOES NOT CONSTITUTE AN APPROVAL OF THE TERMS OR OF THE LENDER’S ABILITY TO ARRANGE ANY LOAN. COMPLAINTS REGARDING THE SERVICES OF RESIDENTIAL MORTGAGE LENDERS SHOULD BE DIRECTED TO THE DEPARTMENT OF FINANCIAL INSTITUTIONS.

Residential Mortgage Loan Servicing

House Bill 1068 creates a new North Dakota Residential Mortgage Loan Servicing License, which is required to engage in residential mortgage servicing as a servicer, subservicer, or mortgage servicing rights investor. We note that the statutory language is not clear regarding the types of activities covered by the new licensing requirement.

The law defines “residential mortgage servicing” as receiving any scheduled periodic payments from a borrower, pursuant to the terms of any federally related mortgage loan, including amounts for escrow, and making the payments to the owner of the loan or other third parties of principal and interest and such other payments with respect to the amounts received from the borrower as may be required pursuant to the terms of the mortgage servicing loan documents or servicing contract. For home equity conversion mortgages or reverse mortgages, this includes making payments to the borrower.

“Servicer” is defined to mean “the entity performing the routine administration of residential mortgage loans on behalf of the owner or owners of the related mortgages under the terms of a servicing contract.”

“Subservicer” is defined to mean “the entity performing the routine administration of residential mortgage loans as agent of a servicer or mortgage servicing rights investor under the terms of a subservicing contract.”

“Mortgage servicing rights investor” is defined as “entities that invest in and own mortgage servicing rights and rely on subservicers to administer the loans on their behalf. Mortgage servicing rights investors are often referred to as master servicers.”

“Service” or “Servicing a loan” is defined to mean the following, when performed on behalf of a lender or investor:

- collecting or receiving payments on existing obligations due and owing to the lender or investor, including payments of principal, interest, escrow amounts, and other amounts due;

- collecting fees due to the servicer;

- working with the borrower and the licensed lender or servicer to collect data and make decisions necessary to modify certain terms of those obligations either temporarily or permanently;

- otherwise finalizing collection through the foreclosure process; or

- servicing a reverse mortgage loan.

Exemptions from licensing are provided for banks, credit unions, savings and loan associations, trust companies, and certain nonprofits. The Residential Mortgage Loan Servicing License will require licensees to maintain a minimum tangible net worth based upon the volume of loans serviced nationwide, with a minimum net worth requirement of $100,000. Special requirements will apply to “large servicers,” which the statute defines, in part, as a servicer with a residential mortgage loan servicing portfolio of 2,000 or more.

Both of the new licensing statutes authorize the North Dakota Department of Financial Institutions to issue regulations. A copy of House Bill 1069 can be found here, and a copy of Senate Bill 2090 can be found here.

- Lisa Lanham & John Georgievski

On April 11, 2023, Equifax, Experian, and TransUnion announced that they removed unpaid medical collections under $500 from consumer credit reports. The three companies, in July 2022, previously removed paid medical collections from credit reports, and extended the delay in medical collection reporting from sixth months after the first delinquency to one year after the first delinquency. In its Data Point released on April 26, 2023, the CFPB reviewed the impact of the removal of medical collection tradelines based on a sampling of credit reports from 2012-2020 and found that removing medical collection tradelines can significantly improve credit scores and credit availability.

In its report, the CFPB focuses on the consumer impact of medical collections because unlike other forms of credit, medical debt is often not incurred voluntarily or with a full understanding of repayment terms. Key findings from the Data Point include:

- Consumers appeared to review reports and seek removal of medical collection tradelines to obtain mortgages, based on data showing increases in first-lien mortgage inquiries in the last quarter in which a medical collection tradeline is reported and increases in the first quarter after a medical collection tradeline is removed.

- An estimated 22.8 million consumer will have at least one medical collection tradeline removed from their credit reports (73% of the population who had medical collections on their credit report in December 2022).

- Consumers could experience a 21 to 32 point increase in their credit scores in the first quarter after their last medical collection tradeline is removed from their credit report, enabling access to credit at lower interest rates and a benefit in any rental screenings and employment background checks.

- Data showed that consumers’ total amount of available revolving credit increased on average by $1,028 and their total amount of available installment credit increased on average by $4,123 six quarters after the last medical collection tradeline was removed from their credit report.

The CFPB has been focused on medical debt reporting under Director Rohit Chopra. In 2022, the CFPB issued three reports on medical debt along with CFPB comments strongly suggesting that the agency was headed in the direction of taking steps to block or limit the reporting of medical debt. In February 2023, the CFPB published its report titled “Market Snapshot: An Update on Third-Party Debt Collections Tradelines Reporting,” analyzing trends in credit reporting of debt in collections and its blog post named “Debt collectors re-evaluate medical debt furnishing in light of data integrity issues,” highlighting factors that create challenges for medical collections reporting. The February report foreshadowed the change to remove small dollar and paid medical collection tradelines.

We will monitor for further developments to see whether the removal of paid medical collections and unpaid medical collections under $500 from consumer credit reports satisfies the CFPB’s desire to mitigate consumer harm from medical debt information or whether it will impose additional requirements on furnishers and consumer reporting agencies.

- Kristen E. Larson

The CSBS has invited public comment on its proposal for new NMLS mortgage business-specific requirements. The proposal covers a wide range of potential changes, including what documents may be required to be uploaded into NMLS by entities engaging in mortgage lending and servicing business activities. The proposal can be viewed here, and any comments are due by May 15 at 5:00 p.m. EST.

What the Biden Administration’s “Junk Fees” Initiative Means for the Consumer Financial Services Industry: A Look at the Fees Under Attack

A Ballard Spahr Webinar | May 16, 2023, 12:00 PM – 1:30 PM ET

Speakers: Alan S. Kaplinsky, John L. Culhane, Michael Gordon, Reid F. Herlihy, & Kristen Larson

An Even Deeper Dive into the CFPB’s Final Section 1071 Rule on Small Business Data Collection

A Ballard Spahr Webinar | June 15, 2023, 12:00 PM – 1:00 PM ET

Speakers: Richard J. Andreano, Jr. & John L. Culhane, Jr.

Subscribe to Ballard Spahr Mailing Lists

Copyright © 2025 by Ballard Spahr LLP.

www.ballardspahr.com

(No claim to original U.S. government material.)

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, including electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of the author and publisher.

This alert is a periodic publication of Ballard Spahr LLP and is intended to notify recipients of new developments in the law. It should not be construed as legal advice or legal opinion on any specific facts or circumstances. The contents are intended for general informational purposes only, and you are urged to consult your own attorney concerning your situation and specific legal questions you have.